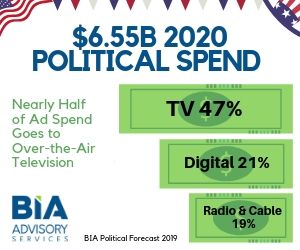

Over-the-air TV will earn 47% of political ad spend in local markets.

BIA Advisory Service estimates $6.55 billion will be spent on local political advertising in 2020, with over-the-air TV receiving the largest share of $3.08 billion – 47% of total political spend in 2020. This represents a potential 16.5% of total local OTA TV advertising revenue for 2020.

Political advertising spend is forecast to vary significantly from market to market, based on the size of the market and how competitive the elections are in that market. “It’s going to be a very interesting political year where some very large markets will not see much in political advertising while some small markets will see an extraordinary amount of advertising due to competitive races, due to Gubernatorial, Senate and House races along with the Presidential election,” said Mark Fratrik, Chief Economist and SVP, BIA Advisory Services.

The top 3 markets for the largest political ad spend will be Los Angeles, CA; Phoenix, AZ; and Philadelphia, PA. In each of these markets, TV OTA will receive over $100 million in advertising.

The more hotly contested the elections are, the better it is for local television stations. Markets located in so-called battleground or swing states will see greater political advertising spend than markets in states that are heavily red or blue. Swing states vary from election to election. If the trends from the 2012 and 2016 elections continue, local televisions stations in states such as Arizona, Maine, Michigan, Minnesota, Pennsylvania, and Wisconsin could benefit from highly competitive political races.

“In some of the smaller markets, one thing to keep an eye on is how the huge volume of political advertising could crowd out other advertisers during primary and general election seasons. That may have an impact on advertisers and media companies, and we’ll certainly factor that into our forecasting as we go through the Fall,” said Fratrik. For example, with a hotly contested Senate race, two markets in Maine, Portland-Auburn (#84) and Bangor (#155), could see over half of their local OTA TV advertising revenue coming from political dollars. Maine’s third-largest market, Presque Isle (#206), could see nearly half of its OTA TV revenue from political according to BIA’s forecast.

BIA’s new political advertising estimates will be provided to the firm’s BIA ADVantage clients. BIA ADVantage delivers local market advertising intelligence for 94 business categories, including political, for every TV and radio market in the nation. For information on how to subscribe or how to purchase the political forecast for a local market, email sales@bia.com. The local political advertising forecast can be purchased online here.