BIA raising original estimate slightly based on strong economy, early political advertising and strength of mobile advertising

CHANTILLY, Va. (July 9, 2019) – In an update to its U.S. Local Advertising Forecast 2019, BIA Advisory Services forecasts the total local media marketplace in 2019 will be slightly stronger than expected earlier in the year, with ad revenue reaching approximately $148.8 billion. The elements supporting the advertising marketplace are a strong economy, an early start to the 2020 election, and most notably, increases in mobile and mobile-social advertising.

CHANTILLY, Va. (July 9, 2019) – In an update to its U.S. Local Advertising Forecast 2019, BIA Advisory Services forecasts the total local media marketplace in 2019 will be slightly stronger than expected earlier in the year, with ad revenue reaching approximately $148.8 billion. The elements supporting the advertising marketplace are a strong economy, an early start to the 2020 election, and most notably, increases in mobile and mobile-social advertising.

Traditional media will retain a significant portion (60 percent) of the overall spend, $89.2B, with digital ad revenue at 40 percent with $59.5B. However, the future of online/digital advertising revenue is progressively increasing, with a 2018-2023 CAGR of 9 percent. Over the same period, traditional advertising revenues will see a decrease in the 2018-2023 period with a CAGR of -1.4 percent.

“This is a very interesting time for local media,” said Mark Fratrik, SVP and chief economist, BIA Advisory Services. “Although it’s a non-political year, the sheer number of Democratic candidates running and the significant attention this presidential race is garnering is driving earlier than usual advertising revenue across television and mobile/social channels. Additionally, we are more bullish on certain digital advertising platforms like mobile due to its targetability, measurability, attribution and high level of adoption by consumers.”

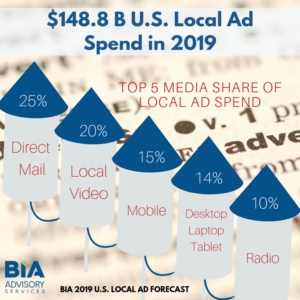

According to the forecast, the top five media (revenue and share of market) in order of largest to smallest contribution in local advertising for 2019:

- Direct Mail: $37.2 billion (25 percent share)

- Direct mail (such as direct solicitation, couponing and catalogs) remains an effective means of communication to reach certain households for national and local advertisers. Note: BIA’s methodology for calculating direct mail ad revenue includes the cost of the full delivery that includes materials and postage, unlike digital that typically has a lower production cost.

- Local Video: $29.5 billion (19.9 percent share) (*Includes local Over-the-Air (OTA) TV, local cable, local online video, out-of-home video, mobile video)

- The local video ad market is becoming very competitive with online, out-of-home and mobile video with OTA TV remaining dominant in capturing local video advertising, even in 2019 without substantial political advertising

- Mobile: $21.8 billion (14.6 percent share)

- Mobile advertising revenue is growing rapidly on all fronts, with the mobile social advertising segment contributing the most to overall spending growth. National advertisers drive a large portion of the localized share of mobile ad revenue.

- Desktop/Laptop/Tablet (Online/Interactive): $20.2 billion (13.6 percent share)

- Desktop advertising continues to become more important to advertisers relative to many traditional media alternatives, with spending increasing across all online segments including online video. Desktop video and desktop search are driving growth and increasing at a double-digit CAGR.

- Local Radio: $14.5 billion (9.8 percent share)

- Competition for audiences continues to erode over-the-air (OTA) advertising revenue, however online efforts by stations are helping to support a slight growth in overall revenue.

“It can be surprising to see that direct mail continues as such an important medium,” commented Fratrik. “However, it directly targets more households than any other channel and mobilizes local consumers to make purchases, especially when combined with campaigns that make use of digital platforms. The key for revenue growth (and protection) today is not just to look at the media in your sector, but across all local media because you compete across all ad channels today.”

About the U.S. Local Advertising Forecast

BIA’s U.S. Local Advertising Forecast 2019 offers a five-year forecast of the top media including direct mail, local video, online/interactive (i.e,. local search and local display), newspapers, mobile, radio, out-of-home/OOH video, directories (i.e. PYP and IYP), social and local magazines.

The forecast delivers a national overview of total U.S. spending in local markets. BIA defines local advertising as all advertising platforms that provide access to local audiences for national, regional and local marketers.

The forecast can be purchased separately, or by subscribing to the firm’s local advertising intelligence dashboard, BIA ADVantage. For more information, email sales@bia.com.

The BIA U.S. Local Ad Forecast is the basis for BIA’s local market forecasts. BIA ADVantage subscribers can access market forecasts by logging into the ADVantage platform.

About BIA Advisory Services

BIA Advisory Services is at the forefront of local media analysis, creating and delivering unique data to examine traditional and digital advertising revenue, advertiser trends and activities, local market profiles and ownership/operational details and the trends and technologies guiding today’s media business.

Since 1983, BIA has been a valuable resource for traditional and digital media companies, brands and agencies, the financial and legal community serving media and telecom, as well as the FCC, DOJ, and other government agencies. Today, we offer comprehensive local market advertising intelligence in our BIA ADVantage service to help clients discover the path to their best opportunities. Learn more about our offerings at https://www.bia.com.

Media Contacts:

MacKenzie Lovings

(703) 802-2991

mlovings@bia.com

Robert Udowitz

(703) 621-8060

rudowitz@bia.com