New state-of-the-industry report points to retransmission consent rate agreements and digital offerings as generating substantial cash flows and investor confidence

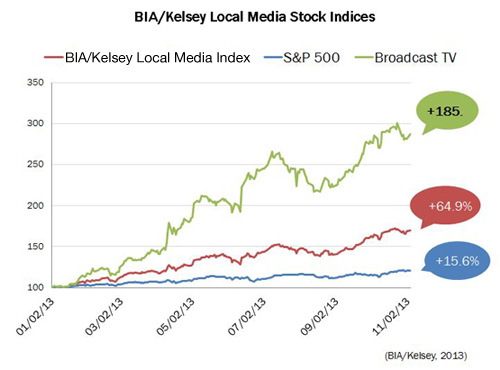

CHANTILLY, Va. (Dec. 19, 2013) – As local television stations continue to generate substantial cash flows, investor confidence has risen, driving stock values up 185 percent in the first three quarters of 2013, according to a new state-of-the-industry report from BIA/Kelsey. Local Television Stations Profiles and Trends for 2014 and Beyond provides a comprehensive view of the industry based on long-term research and analysis conducted by BIA/Kelsey for its clients and the industry.

The new report notes that in the first three quarters of 2013, the S&P 500 index increased by 15.6 percent, while BIA/Kelsey’s comprehensive Local Media market capitalization index, which includes more than 55 local media companies, rose by 64.9 percent. Broadcast television was on top with the highest growth in the index.

“The advertising revenue pendulum of the local television industry swings predictably between odd and even years,” said Mark Fratrik, BIA/Kelsey’s chief economist and report author. “However, an interesting way to look at the future of the local television industry is to examine two-year revenue changes, which remove the dramatic ups and downs associated with election and Olympics years. With strong negotiations around retransmission consent agreements and expansion of digital offerings beyond the over-the-air base, we anticipate the industry to average between 5 and 8 percent increases every two years, or 2.5 to 4 percent increases per year.”

Local television stations are using the income boost from retransmission consent agreements with local cable, telco and national satellite distribution services to invest in their programming and develop new services. From over $2 billion in 2012, BIA/Kelsey predicts retransmission consent revenue is expected to triple by 2018, representing a 20.6% compound annual growth rate (CAGR) during that time.

BIA/Kelsey estimates total local media spending for 2013 to be $132.7 billion. This marketplace includes all of the media that local television stations compete against for national and local advertising spending in their markets. Based on this definition of local advertising, local TV stations receive 14.9 percent of all advertising revenue spent in local markets, third among local media segments, behind direct mail (27.2 percent) and newspapers (16.1 percent).

However, the overall media marketplace shares mask the strength of television within certain groups of advertisers, at present and in the future, according to the new report. For example, BIA/Kelsey estimates that automotive dealers will use 30 percent of their annual $12.5 billion advertising budget on local television stations this year alone.

Availability of Local Television Stations Profiles and Trends for 2014 and Beyond

Local Television Stations Profiles and Trends for 2014 and Beyond delves deeply into all the competing factors affecting TV’s potential to thrive in the new video and advertising marketplace. It includes an examination and current data on the many viewing options available to consumers, particularly where people get their news and how and when it’s viewed. It also includes the expansion and improvement of product offerings with advancement in technology. And it covers the many regulatory and legal issues associated with local television station ownership and copyright of the programming aired on these stations.

Accompanying the 55-plus-page report is a companion chart-based PowerPoint deck summarizing its top findings. This asset is invaluable when creating custom presentations for board and financing meetings or strategic retreats.

The report delivers a comprehensive assessment of the television industry and is a useful resource for anyone focused on the trends and direction of local TV, including ownership groups and financial institutions, and companies building interactive digital solutions being embraced by the industry.

The report includes the following analysis and information:

- Executive Summary

- Viewer Options

- Revenue History of Local Television Stations

- Retransmission Consent and Reverse Compensation

- Technological Change at Local Television Stations

- Regulatory Change at Local Television Stations and Other Legal Issues

- Station Trading Activity

- Conclusions

- Appendix – Market Sizing

- Appendix – The BIA/Kelsey Digital Sales Transformation Playbook

More information about the report and how to purchase it is available at https://www.bia.com/Research-and-Analysis/Reports/State-of-the-Industry-TV or by emailing sales@biakelsey.com.

About BIA/Kelsey

BIA/Kelsey advises companies in the local media space through consulting and valuation services, research and forecasts, Custom Advisory Services and conferences. Since 1983 BIA/Kelsey has been a resource to the media, mobile advertising, telecommunications, Yellow Pages and electronic directory markets, as well as to government agencies, law firms and investment companies looking to understand trends and revenue drivers. BIA/Kelsey’s annual conferences draw executives from across industries seeking expert guidance on how companies are finding innovative ways to grow. Additional information is available at https://www.bia.com, on the company’s Local Media Watch blog, Twitter (http://twitter.com/BIAKelsey) and Facebook (http://www.facebook.com/biakelsey). Stay connected by subscribing to the firm’s bi-monthly newsletter.

For more information contact:

Eileen Pacheco

For BIA/Kelsey

(508) 888-7478

eileen@tango-group.com

Robert Udowitz

For BIA/Kelsey

(703) 621-8060

rudowitz@biakelsey.com