BIA/Kelsey’s new ad forecast reveals the mixture of a robust economy going into 2018, a competitive political landscape and significant growth in mobile/social media will drive significant increase in the local advertising revenue.

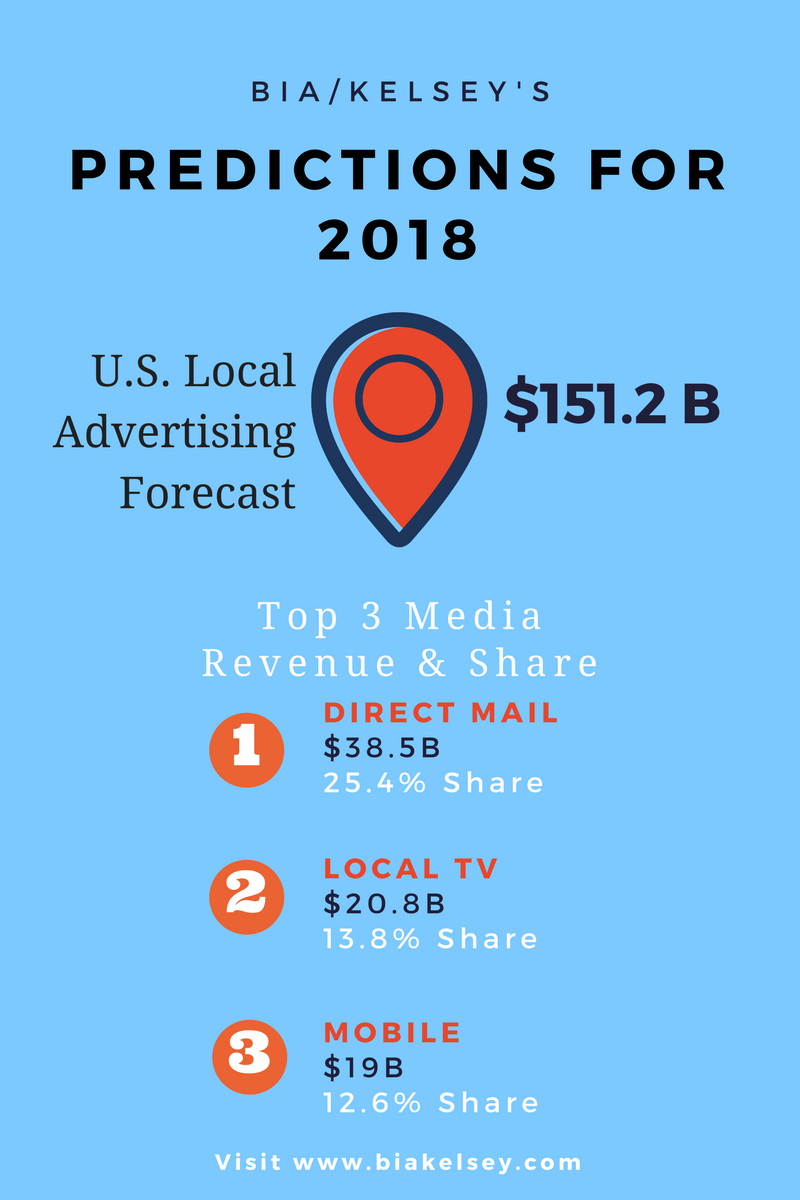

CHANTILLY, Va. (Dec. 6, 2017) – BIA/Kelsey’s U.S. Local Advertising Forecast 2018 projects total local advertising revenue in the U.S. will reach $151.2 billion in 2018, up from $143.8 billion this year, representing a growth rate of 5.2 percent. Traditional media will comprise 64.7 percent of the revenue, with online/digital securing 35.3 percent. BIA/Kelsey defines local advertising as all advertising platforms that provide access to local audiences for national, regional and local marketers.

“The strong economy and the expectation of highly-competitive statewide political races next year reinforce our outlook that local advertising revenue will show strong growth in 2018, in fact, higher than we’ve seen for five years,” said Mark Fratrik, chief economist and SVP at BIA/Kelsey. “Combine these factors with the continued strength of traditional and online media and the revenue landscape for next year looks robust.”

“The strong economy and the expectation of highly-competitive statewide political races next year reinforce our outlook that local advertising revenue will show strong growth in 2018, in fact, higher than we’ve seen for five years,” said Mark Fratrik, chief economist and SVP at BIA/Kelsey. “Combine these factors with the continued strength of traditional and online media and the revenue landscape for next year looks robust.”

Key findings from the forecast include:

- Direct mail preserves its lead position with a 25.4 percent ($38.5 billion) slice of the local advertising pie. High response rates of around three to five percent, and a return on investment comparable to some digital media, combine to make DM appealing to advertisers.

- Local television continues as second media at 13.8 percent ($20.8 billion). It will continue to be the largest player (more than 60 percent) in the local video advertising market. Revenue growth within the total local video advertising segment will come from local mobile video (growing to more than $1 billion) and local online video (increasing to more than $2 billion).

- Mobile will move into the third position, representing 12.6 percent of local advertising spend in 2018. This category will grow to 19.2 percent by 2022. Adoption of mobile local advertising tactics (e.g., geo-fencing, click-to-call and click-to-map) continues to grow among national advertisers that tend to gravitate toward effective, increasingly available and currently undervalued mobile local ad inventory.

The forecast also projects significant ad spending in native social advertising next year due to its ability to target and reach local consumers. Social media ad revenues from mobile (not including tablets) now represent about 71 percent of total social ad spending and will grow to nearly 80 percent by 2022 as more of the user activity shifts away from desktops.

“Social channels such as Snapchat and Instagram have evolved their mobile native ad models to include new targeting and reporting features, “Fratrik said. “As mobile and social local channels continue to deliver high performance results for advertisers, advertising dollars will flow to these areas. Indeed, pushed by increased consumer use, agencies will budget more of their spending into locally activated mobile products and services.”

About the U.S. Local Advertising 2018 Forecast

BIA/Kelsey’s 2018 U.S. Local Advertising Forecast is a five-year prediction that includes a national overview of total locally activated U.S. ad spending and individual analysis and forecasts for the following media: direct mail, local video (including local over-the-air television, local cable television, out-of-home video, mobile video), Out-of-Home (OOH), Online, Radio, Social (including breakouts for desktop/tablet and mobile social), mobile (including breakouts for location and non-location targeted mobile media), Directories, Newspapers and Magazines.

BIA ADVantage clients can login to the dashboard to view the full forecast. A client briefing will be held on Wednesday, Dec., 13. The forecast can also be purchased separately online. For information on gaining access to the forecast by becoming a BIA/Kelsey client, contact Mark Giannini, COO and SVP, business development, at mgiannini@biakelsey.com or (703) 818-2425.

About BIA/Kelsey

BIA/Kelsey (@BIAKelsey) combines data, analytics and insights to provide its clients with the information they need for grounded financial and strategic action. Since 1983, BIA/Kelsey has been a valuable resource for many of the leading companies in media and the financial and legal community serving media and telecom, as well as the FCC and other government agencies. Today, BIA/Kelsey offers a broad range of research, consulting services and conferences to traditional and new media companies. Learn more about BIA/Kelsey at www.biakelsey.com.

Additional information is available at https://www.bia.com, on the company’s Local Media Watch blog, Twitter, and Facebook. Sign up for the company’s newsletter Local Media Daily, that covers different areas of media and technology.

Media Contacts:

MacKenzie Lovings

(703) 802-2991

mlovings@biakelsey.com

Robert Udowitz

(703) 621-8060

rudowitz@biakelsey.com