Political and other key verticals offer some opportunity for revenue generation for fourth quarter. BIA will discuss preparing for fourth quarter and 2021 during an executive webinar Aug. 18.

CHANTILLY, Va. (Aug 12, 2020) – Examining the continuing economic fallout from the coronavirus in recent months, BIA Advisory Services has adjusted its estimate for the total local advertising market for 2020 to $140.4 billion, down from $144.3 billion in April. BIA’s updated forecast estimate represents a 6.1 percent decline from 2019, even with strong political advertising anticipated this year and a few business verticals showing advertising strength.

“To update our post-COVID forecast from April, we analyzed the continuing impact on local advertising by the weakened economy, continuing job loss reports, and the downturn in some key business verticals,” said Mark Fratrik, SVP and Chief Economist, BIA Advisory Services. “Right now, we believe a realistic view of the economy overall and the advertising marketplace is that after a dramatic decrease in the second-quarter and a bumpy start to the third, the remainder of the year will turn positive but end up with an overall decline in local advertising for the year.”

Local political ad spend continues to be one positive area. As campaigns continue to migrate to online rallies and events, both presidential and down ballot candidates are spending significant dollars in local broadcast and digital advertising. Since its April forecast, BIA increased the expected political ad spend from $7.1 billion to $7.3 billion. Of the $209 million increase, the distributed share to different media include $138 million to TV OTA, $40 million to Cable, $26 million to Online/Digital, and $5 million to Radio OTA.

The verticals showing some COVID resilience include healthcare and finance & insurance. While both are down in terms of overall ad revenue spend, these industries have solid areas of steady and even slightly increasing ad spend.

Within healthcare, health and personal care stores are estimated to spend $97.6 million in 2020 and pharmaceutical and medicine manufacturers are forecast to spend $658.3 million to promote wellness products and services. In terms of finance & insurance, as people want help rebuilding their savings, college funds and retirement accounts, companies in consumer & lending stores are forecast to spend $1.6 billion while investment & retirement stores are projected to spend $3.0 billion in local advertising this year.

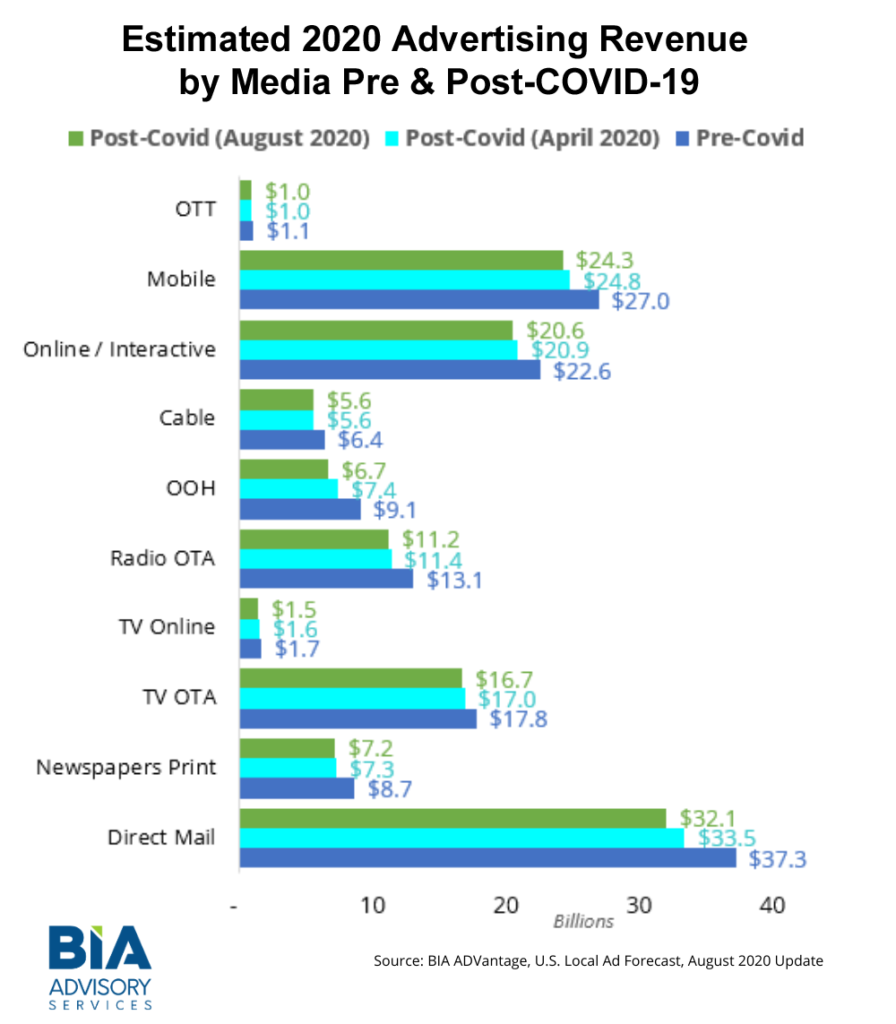

As for overall media ad spend, when comparing ad revenue estimates of both pre- and post-COVID, all media, except over-the-top (OTT), are experiencing a decline in ad revenue, as shown in the chart below.

“The economic situation caused by the pandemic continues to create a difficult local advertising market,” said Tom Buono, CEO and Founder BIA Advisory Services. “It’s critical to examine where the advertising dollars are flowing and what your particular business can go after. As ad budgets shift, an understanding of what is happening in your local market represents a real opportunity to expand your share of wallet.”

BIA will join SalesFuel to present local advertising data and analysis during the webinar, Accelerating 4th Quarter Revenue: Planning for 2021, on Tuesday, August 18 at 11 am eastern. The webinar will help executives organize their sales plans and prepare revenue assessments.

Local Market Ad Estimates

In addition to BIA’s nationwide estimates reported in this announcement, BIA has issued an advertising forecast update for every local Television and Radio market in its BIA ADVantage platform. The forecast offers BIA’s new analysis of the impact of the pandemic on local advertising across 12 media and 95 business verticals.

BIA ADVantage clients can login here to access their local market intelligence. For details on your local market forecast, email us at advantage@bia.com.

Additional COVID Analysis

BIA is offering complimentary analysis on its updated forecast and steps that will help companies prepare for the rebound BIA here.

About BIA Advisory Services

BIA Advisory Services is the leading authority for data-centered insights, analysis, strategic consulting and valuation services for the local media industry. Since 1983, BIA has been a valuable resource for traditional and digital media companies, brands and agencies, the financial and legal community serving media and telecom, as well as the FCC and other government agencies. Today, we offer comprehensive local market advertising intelligence in our BIA ADVantage service to help clients discover the path to their best opportunities. Learn more about our offerings at https://www.bia.com.