Political, OTT and Digital Advertising Will Slightly Balance the Negative Effect of the Pandemic on Local Advertising

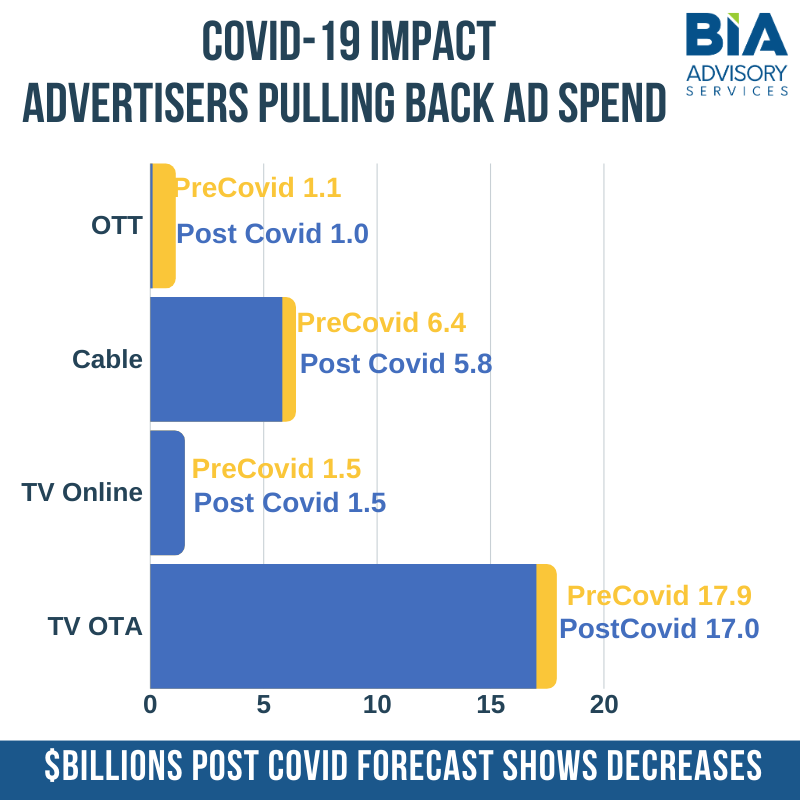

CHANTILLY, Va. (May 21, 2020) – BIA Advisory Services’ has lowered its early second quarter 2020 forecast for U.S. local TV advertising due to the COVID-19 pandemic. Its new revenue estimate is $18.5 billion, broken down to $17 billion for over-the-air revenue and $1.5 billion for digital revenue, compared to the $19.4 billion forecast earlier this year. Overall, the numbers still reflect the election year and a slight increase over 2019.

In addition to accessing the quarterly estimates in BIA’s Investing In® Television Q1 Market Report and MEDIA Access Pro, BIA has published a new area in BIA ADVantage offering access to individual Local TV Market Profiles and Station Overviews.

“Local television stations, like all media, will see significant decreases in advertising from many business verticals like travel, leisure and retail,” said Mark Fratrik, SVP and chief economist at BIA Advisory Services. “Political advertising will buffer those decreases in many markets that have competitive Senatorial and Gubernatorial races and in Presidential battleground states. Plus, continued growth in OTT and digital will help to soften the impact of the pandemic on advertising revenue.”

When examining the local advertising marketplace for television stations, areas the least affected by COVID include political advertising, over-the-top (OTT) and digital advertising. BIA estimates that $7.1 billion will be spent on local political ads through Q4 this year. Of that, over-the-air (OTA) will get 45.8 percent share of the political ad spend. Additionally, as political advertisers grow their spend in OTT, local TV owners will also benefit.

The forecast also reflects $10.44 billion in retransmission consent agreements between local television stations and cable/satellite companies/virtual MVPDs expected in 2020. BIA predicts that on a market-by-market basis, retransmission fees will continue to rise, based primarily on rate increases in each market.

Speaking to the forecast, Fratrik offers, “Since we completed this forecast in early April, over 25 million Americans have filed for unemployment insurance and there is continuing economic concerns as the country moves to open back up. We expect political advertising will increase very quickly, and we anticipate certain verticals will rebound more quickly than others. It is going to be a dynamic marketplace this year, and we will continually monitor the nationwide and local economies to update our forecast based on new information.”

Accessing BIA’s Television Station Forecasts

BIA just announced new Local TV Market Profiles and Station Overviews are now available in the BIA ADVantage platform for every local TV Market to help local television stations examine their current state. This new offering delivers the following estimates and data for every television market:

- Local TV market competition and revenue

- TV market revenues (Over-the-air, Online and Retransmission) for 8 years.

- National/Regional vs Local Breakout

- OTA Advertising Revenue Metrics

- Station directory and multi-cast stations

- Local data such as ethnic populations, household incomes, per capita income, retail sales, average, population and more

For more details on accessing a particular local market forecast in BIA ADVantage, email advantagereports@bia.com. Current clients can access the Local TV Market Profiles and Station Overviews now in BIA ADVantage.

Additionally, a comprehensive profile of all 210 television markets (plus Puerto Rico) is available in the first-quarter edition of Investing In Television® Market Report and in BIA’s software database, MEDIA Access Pro™, which delivers comprehensive information on the radio, television and newspaper industries.

About BIA Advisory Services

BIA Advisory Services is at the forefront of local media analysis, creating and delivering unique data to examine traditional and digital advertising revenue, advertiser trends and activities, local market profiles and ownership/operational details and the trends and technologies guiding today’s media business.

Since 1983, BIA has been a valuable resource for traditional and digital media companies, brands and agencies, the financial and legal community serving media and telecom, as well as the FCC and other government agencies. Today, we offer comprehensive local market advertising intelligence in our BIA ADVantage service to help clients discover the path to their best opportunities. Learn more about our offerings at https://www.bia.com.

# # #

Contact:

MacKenzie Lovings

SVP Data Products & Marketing

703.606.3481

mlovings@bia.com

Robert Udowitz

(703) 621-8060

rudowitz@bia.com