Auto Dealers, Local Dealer Associations, and Manufacturer Ad Spending Accounts for 76 Percent of Total Advertising for Auto Vertical.

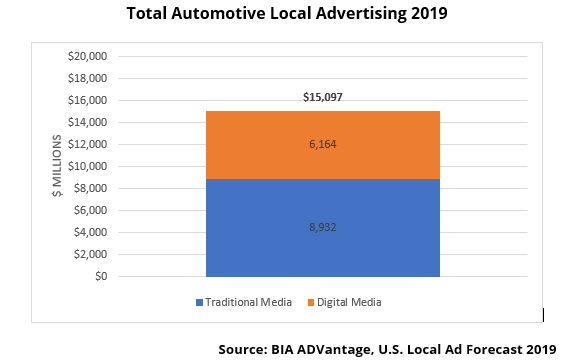

CHANTILLY, Va. (March 6, 2019) – In its latest vertical industry report, “Insights into Local Advertising – Automotive Vertical,” BIA Advisory Services estimates that automotive dealers, local dealer associations, and manufacturers will spend approximately $11.3 billion on local advertising nationally in 2019. This ad spend represents 75 percent of the $15.1 billion auto vertical, which makes auto dealers the largest of the five sub-verticals that comprise the overall auto vertical. The remaining spend comes primarily from tire dealers, auto repair and parts shops, as well as other vehicle dealers.

As in past years, traditional media will receive the greatest share of the ad spend, followed by online ad spending. Auto dealers and manufacturers are projected to increase their use of digital channels significantly over the next four years, adding $324 million annually from 2019 to 2023.

“Businesses within the automotive vertical still rely heavily on traditional media, over-the-air television in particular, to get their message across to audiences,” said Dr. Mark Fratrik, SVP and chief economist BIA Advisory Services. “Our research shows that automotive is one of largest category spenders in TV advertising. Digital advertising is growing steadily and faster than before.”

In 2015, BIA projected that despite traditional media’s dominance in the current automotive marketing mix, digital advertising would represent around one-third of automotive local ad spending by 2019. The firm now forecasts that digital advertising will represent 40.8 percent of the ad spend this year and that digital media spending within the overall auto vertical will represent 49.3 percent of total local advertising in 2023. Pure online advertising, consisting primarily of vertical search, is the largest digital automotive channel.

“Don’t discount TV as a media channel for driving auto sales while digital continues to grow,” continued Fratrik. “Dealers and their local associations are aligning their marketing strategies to target today’s auto buyers that are using a mix of media like TV and radio along with digital-review sites, local dealer websites, search engines and social media to educate themselves during their buying journey. Ad sellers who understand and sell value and targeted cross-platform advertising will be very successful.”

About the Auto Vertical Ad Report

The automotive vertical report is designed to help local media organizations understand the media spending trends and behaviors of advertisers within key vertical industries. The data featured in the report is drawn from BIA ADVantage that includes BIA’s 2019 Nationwide Local Ad Forecast and local market forecasts for all 210 local television markets, top twelve verticals and 94 sub-verticals. Figures and tables in the report include:

- 2019 Per Capita Automotive Ad Spending in Top 10 Markets

- 2019 Distribution of Automotive Spending by Media

- 2023 Automotive Advertising Spending by Local Media

- Distribution of Online Spending by Type

- Auto Spend per Population in Top 50 TV Markets

The report also examines media’s impact on how consumers search for, purchase and maintain automobiles, as well as how consumer behavior affects marketing and media spend.

Accessing the Report

BIA ADVantage subscribers can login to access the report and run custom auto reports for local markets. The report can be purchased on our shop.

About BIA Advisory Services

BIA Advisory Services is the leading authority for data-centered insights, analysis, strategic consulting and valuation services for the local media industry. Since 1983, BIA has been a valuable resource for traditional and digital media companies, brands and agencies, the financial and legal community serving media and telecom, as well as the FCC and other government agencies. Today, we offer comprehensive local market advertising intelligence in our BIA ADVantage service to help clients discover the path to their best opportunities. Learn more about our offerings at https://www.bia.com.

Media Contacts:

MacKenzie Lovings

(703) 802-2991

mlovings@bia.com

Robert Udowitz

(703) 621-8060

rudowitz@bia.com