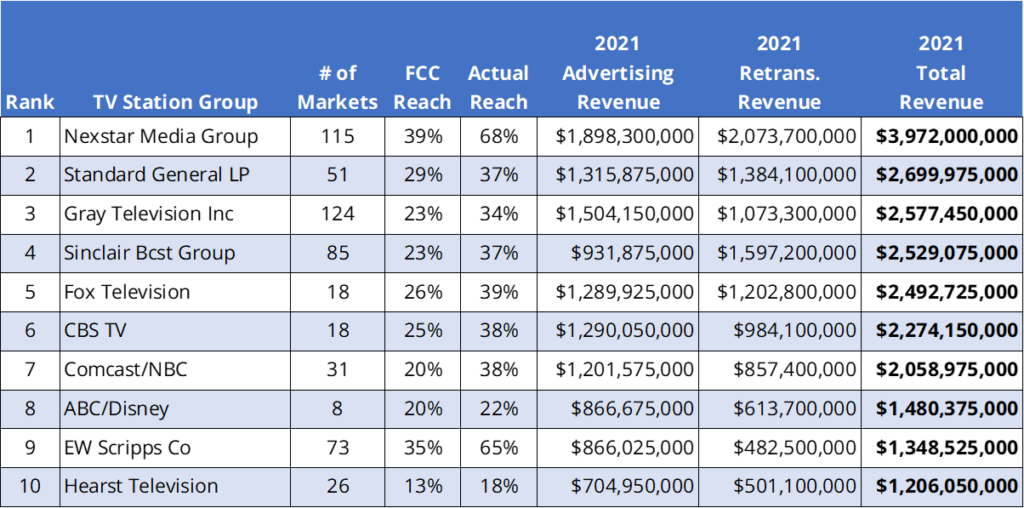

In what should come as a surprise to absolutely no one, Nexstar Broadcasting remains the Top TV station group by total revenue in 2021. With nearly $4 billion in total revenue (nearly $1.9 billion in advertising revenue and $2.1 billion in estimated retransmission* revenue), up from $3.6 billion in 2020 ($2.1 billion in advertising and $1.5 billion in retrans revenues).

The biggest change is that Standard General, thanks to its pending acquisition of Tegna, now occupies the 2nd spot. But before you cry foul and tell me that 1) the Standard General/Tegna deal wasn’t announced until 2022, and 2) the deal hasn’t even closed yet… it wouldn’t make any difference in the rankings. Looking at the list without the Standard General/Tegna acquisition, BIA’s new head of forecasting, Nicole Ovadia remarked that “Tegna would have surpassed Gray, moving from third to second this year on our list even without the sale to Standard General.”

Standard General/Tegna combined had $2.7 billion in revenues in 2021 ($1.3 billion in advertising and $1.38 billion in retransmission). The only TV station included in those totals that Standard General isn’t acquiring from Tegna is WFXT(TV) in Boston, which it is currently acquiring from Cox.

Following Nexstar and Standard General/Tegna, is Gray Television, which was the number two station group in 2020. Despite several acquisitions that closed in 2021, Gray dropped to the number 3 spot with total revenues of $2.6 billion ($1.5 billion advertising/$1.1 billion retrans revenues), down from $3.3 billion ($2.0 billion advertising/$1.3 billion retrans revenues) in 2020.

Standard General/Tegna and Gray swapping places in the top 3 is the only change in order in the Top 10 station group owners between 2020 and 2021.

As Nexstar maintains duopoly partnerships (ie – Joint Services Agreements and/or Shared Services Agreements) with Mission Broadcasting-owned TV stations, we have combined Nexstar and Mission’s revenues for this list. The same holds true for Sinclair, which has similar agreements with TV stations owned by Stephen Mumblow and Cunningham Broadcasting.

This brings us to #4 on the list – Sinclair Broadcast Group, which had $2.5 billion in total revenues (nearly $932 million in advertising and $1.6 billion in retrans revenues) in 2021, down from $2.78 billion ($1.28 billion advertising/$1.5 billion retrans) in 2020. Without a boost from the TV stations owned by Stephen Mumblow and Cunningham Broadcasting, which on their own would each have ranked in the top 25 owners, Sinclair would have been in 6th place.

The next four station group owners are the broadcast networks with their O&O (owned & operated) TV stations: Fox Television (5th with $2.5 billion total), CBS TV (6th with $2.27 billion), Comcast/NBC (7th with $2.06 billion), and ABC/Disney (8th with $1.5 billion).

Rounding out the top 10 station owners list are EW Scripps Co with $1.35 billion and Hearst Television with $1.2 billion in total revenues.

Retransmission consent agreement revenues have had a profound impact on station owners’ total revenues. Just looking at advertising revenue, without estimated retransmission revenues, Nexstar would still be on top, but Gray would have retained the #2 spot, followed by Standard General/Tegna, CBS, and Fox. Based on advertising revenue alone, Sinclair would be in 7th place.

In a video interview with TVNewsCheck, BIA’s now retired SVP and Chief Economist Dr. Mark Fratrik weighed in on retransmission revenue, noting that retransmission revenue “is slowing down, obviously with cord-cutting and cord-nevering. There are many people — many younger people — who won’t be subscribing to an MVPD. On the other hand, they may be subscribing to a virtual MVPD or Hulu Live, YouTube Live, where they do get access to the local television stations. And those services do provide retransmission consent payments to local television stations, much like the cable operators [and] the satellite operators.”

Dr. Fratrik noted that local television stations may still increase their retransmission revenues because of existing agreements with MVPDs that include rate increases, even as subscriber counts decline.

BIA provided the top 30 stations to TVNewsCheck for its annual posting. You can view the full list here.

*BIA estimates retransmission consent revenues at the station level, as this information is typically not publicly disclosed by the stations, the owners, or the MVPDs. BIA’s estimates are based on publicly available information.