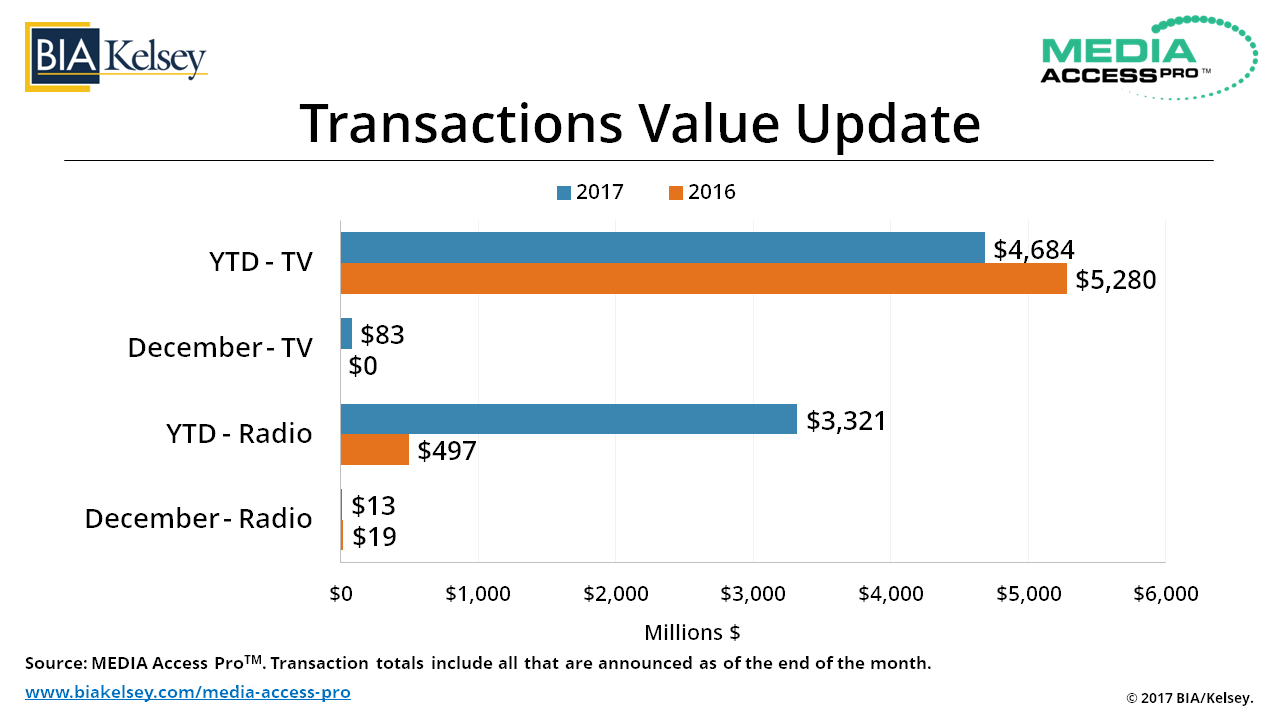

In terms of radio and television station transactions, the past year was strong but not overwhelming. As shown in the year end totals, BIA/Kelsey reports that the total number of television stations sold in 2017 were 107 for a total value of nearly $4.7 billion. For radio, there were 755 stations sold in 2017 for a total value of over $3.3 billion. (See transaction and value charts.)

The number of television stations sold increased by ten over the previous year while the total value of those stations sold decreased by nearly $600 million. On the other hand, the number of radio stations sold increased by 179 and the total value of those stations also increased by over $2.8 billion. Those increases can be credited to the Entercom acquisition of CBS Radio during the year. The stations acquired by Entercom were in many large and medium sized markets, and many of them were very successful ongoing operations. What is worth noting is the fact that Entercom was able to finance this transaction and successfully integrate these stations into their operation. It’s a very good sign for the local radio industry when business success follows such a major acquisition.

Now, what about 2018? Late in the year, the Federal Communication Commission issued new relaxed regulations concerning local ownership of local television stations, and relaxed regulations surrounding local television-radio and local broadcast-local newspaper ownership. While there is some question as to whether some or all of these new regulations will be challenged in the courts, there is some optimism that this relaxation will lead to an increase in station trading activity.

The other key driver for increased activity was the passage of tax reform late in 2017. By lowering the overall corporate tax rate and full expensing of new capital equipment for five years, the values of broadcast properties (much like most other businesses) will most likely increase. This potential positive influence on these values should be taken in context of the longer-term trend of values reflecting the increased competition faced by local radio and television stations.

We’ve already seen some increases in the values of publicly traded broadcast companies while the negotiations and passing of this legislation was occurring. Of course, it will take some time in the marketplace for these increased values to lead to higher prices for radio and television stations.

At the same time, the continuing strengthening economy and the record high DOW can’t be overlooked as it can all affect station transaction activity. Coupled with the impact of the deregulation and the new tax legislation, this stronger economy may lead to increased activity by some of the publicly traded broadcast companies, as well as privately held companies looking to expand. BIA will be watching closely and delivering quarterly analysis – stay tuned!

Note: Considering a sale or purchase? Our valuation team is offering a free 30-minute consultation to discuss opportunities. Email us if you’d like to schedule a time to talk.