The 2022 midterm elections, like fall, are fast approaching and some areas of the U.S. are going to be inundated with more political advertising than others, according to data from BIA Advisory Services. My home state of Virginia will be (relatively) quiet this year, with only U.S. House and local election campaigns. Nearby Maryland, on the other hand, has a Senate election and a Gubernatorial election. But even spending in Maryland is going to be dwarfed by what’s coming in states like Georgia, Ohio, Arizona, Kansas, and Alaska.

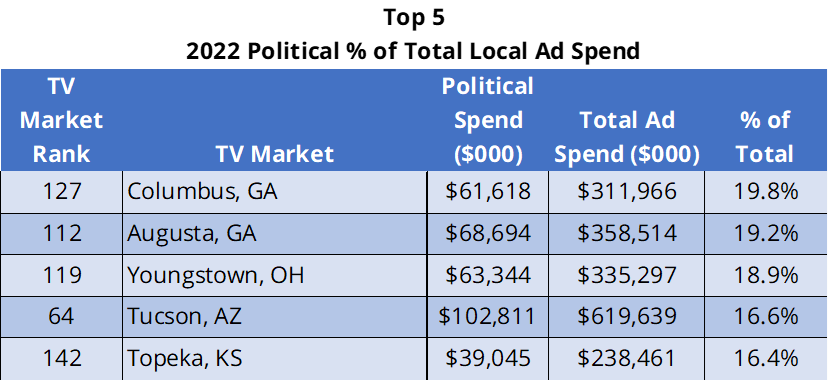

Political local ad spend of $8.6 billion might be just 5.1% of BIA’s total ad local ad spend forecast of $167 billion in 2022 but in some local markets, political is accounting for close to 20% share of ad spend.

Almost 20% of local ad spend in Columbus, Georgia this year will go to political advertising and 19.2% will go to political in Augusta, Georgia. After a run-off in 2020 to replace a Senator who resigned with two years remaining to his term, Georgia has another Senate election for that seat, the typical mid-term U.S. House elections, and a Gubernatorial election this year. Other states in the top 5 Ohio, Arizona and Kansas also have Senate, House and Gubernatorial elections in 2022.

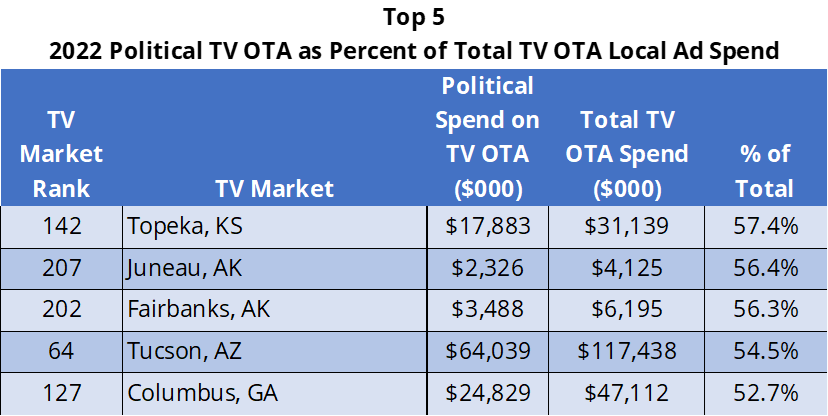

Political Spend on Over-the-Air TV accounts for 44% of Total OTA TV Spend

Markets in four states, Kansas, Alaska, Arizona and Georgia have the largest percent of total over-the-air TV advertising spend coming from political. Alaska also has a Senate election, US House elections, and a Gubernatorial election. TV viewers in these states will be bombarded with political ads this fall.

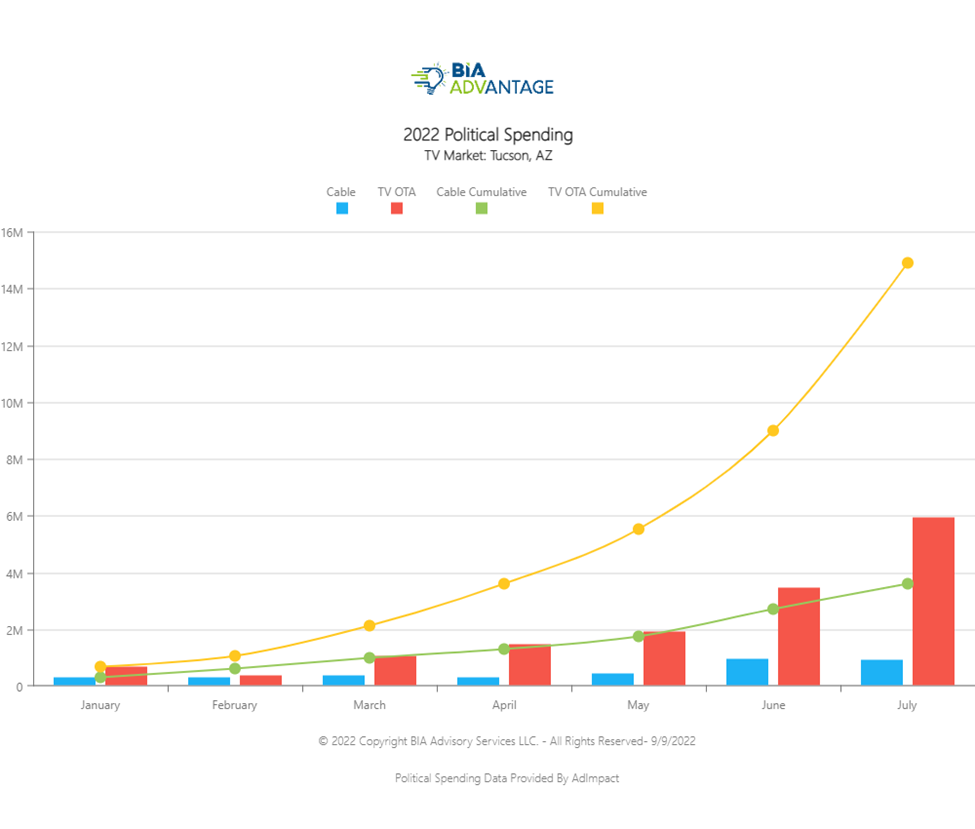

Let’s look at one hot market, Tucson, and the monthly increase to midterms in TV and cable spending. According to BIA’s forecast, 62.3% of political spend in the Tucson market is going to TV OTA ($64.0 million) and 14.4% to Cable TV ($14.8 million).

We are working with AdImpact to provide granular political spending for Tucson which shows through July 2022 TV OTA had reached a cumulative $14.9 million and Cable $3.6 million. As you can see in the AdImpact chart below, spend on local political ad spend TV OTA in the Tucson market is quickly ramping up and, based on BIA’s forecast, spend will explode over the next few months.

These political spending charts offer predictors of final spending across TV OTA and Cable. Updated monthly, they are available in BIA ADVantage for each of the 210 local television markets on the Market Summary page. We will be posting August spending in mid-September.

To keep a close watch on political ad spend this fall, this post is the second in a series we are planning. Stay tuned for more!

For more information about BIA and AdImpact political spending intelligence, email BIA to discuss how we can help you capitalize on all the spending in your market for political and 96+ other leading business verticals. BIA’s new political advertising estimates are available to the firm’s BIA ADVantage clients. The local political advertising forecast can be purchased online here.