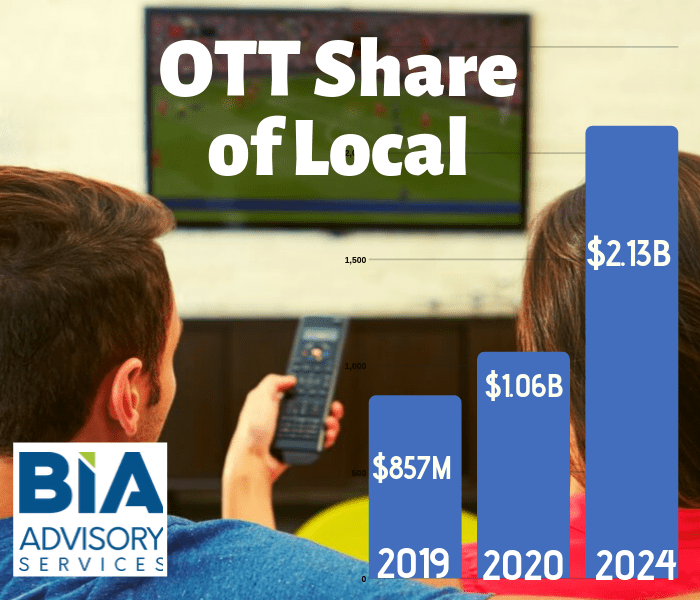

Last week BIA posted our first look at our new OTT Local Ad forecast, showing a fast growth curve from about $850 million this year to over $2 billion by 2024.

Digging a bit deeper into what’s behind our forecast, we see the early spending to be focused on Connected TV (CTV) platforms. BIA defines OTT and IP video delivered to any device supporting a full episode player. CTV is a subset of OTT and refers to OTT IP video delivered to a TV set as the viewing device type.

As linear TV audiences fragment and roll off the platform, buyers going to CTV to find them and buy impressions. We have three reasons for this: (1) CTV dollars are competitive for linear TV dollars, (2) CTV delivers premium video impressions that advertisers are targeting, and (3) the tech and data stacks are in place to drive this market forward at a fast pace. Let’s dig into each area a bit more.

CTV Competes with Linear TV. Ad spending is gushing into CTV because of the dramatic increase in viewer impressions on this platform. Buyers are looking to target video impressions in CTV that they’re losing with audience declines and more fragmentation in linear TV. Estimates are that half of all OTT impressions are CTV, twice that of mobile. Some argue CTV soon will surpass mobile ad spend. By 2018, CTV had already surpassed all other video platforms, including mobile, in impressions and completions. The TV screen brings a larger image, higher CPMs, more ad creative real estate, more immersive audience experiences and a premium video content environment. These huge positives and other factors led Magna to conclude CTV is the fastest growing ad platform overall.

CTV Delivers Premium Video Impressions that Advertisers Are Buying. FreeWheel data show that, “total premium video ad views in the US grew by 20% in Q1 2019.” Concomitantly, FreeWheel also shows, “audience targeted advertising campaigns for premium digital video have increased by 48% y-o-y.”

CTV Tech and Data Stacks Are in Place. The infrastructure and workflow to buy and sell CTV impression inventories have matured nicely. Audience targeting is critical, but of course CTV is a cookie-less environment. This then required the industry to develop a new solution that arrived in the form of IAB’s IFA (Identifier for Advertisements) tags. Comscore, Adobe Audience Manager, Oracle Data Cloud, Google Display & Video 360

eamed with advertising platforms Adobe Audience Manager, Google Display recently teamed to make, “age and gender demographics available for audience targeting within connected TV (CTV).”

Together, these three factors combine with other CTV positives to drive continuing and significant uplift not only in CTV video impressions inventory, but those impressions are being monetized at high grow rates in locally targeted campaign activations.

BIA’s Local OTT Forecast will be available for 210 local TV markets this month. Clients will automatically see this in our BIA ADVantage platform. If you’re a client, stay tuned for details on this major forecast release. If you’re not a client, contact us for details on how to get our local media forecast covering top media like OTT.