Proprietary survey of small to medium-sized businesses (SMBs) that spend at least $25,000 a year on marketing reveals increased spending plans and use of multiple platforms for 2017.

CHANTILLY, Va. (Feb. 27, 2017) – New findings from BIA/Kelsey’s proprietary research survey, Local Commerce Monitor™ (LCM), reveal that more than 60 percent of “Plus Spender” small and medium-sized businesses (SMBs) are intending to increase their advertising and marketing spending in 2017. For this 20th wave of this survey, BIA/Kelsey expanded the number of respondents in this group and the breadth of questions. This group of higher spending SMBs continues to add media to their advertising mix and, on average, is now using 20.8 different media and platforms, which includes a number of new online categories BIA/Kelsey is tracking for the first time.

LCM is the firm’s proprietary survey of SMBs to track the advertising and promotional spending intentions of both Plus Spenders (SMBs that spend at least $25,000 a year) and Core Spenders (SMBs that spend less than $25,000 a year). The most recent wave is LCM 20, which was conducted in the third quarter of 2016.

“SMBs are benefiting from the lower costs of digital media, as well as the opportunity to do more of the implementation themselves,” said Celine Matthiessen, vice president analysis and insights, BIA/Kelsey. “The key takeaway for businesses pursuing this segment of SMBs is that they are investing the savings back into their advertising and marketing plans. This could potentially create more opportunity for new types of digital services in areas like mobile and social, as well as ensure spend on reliable traditional media advertising.”

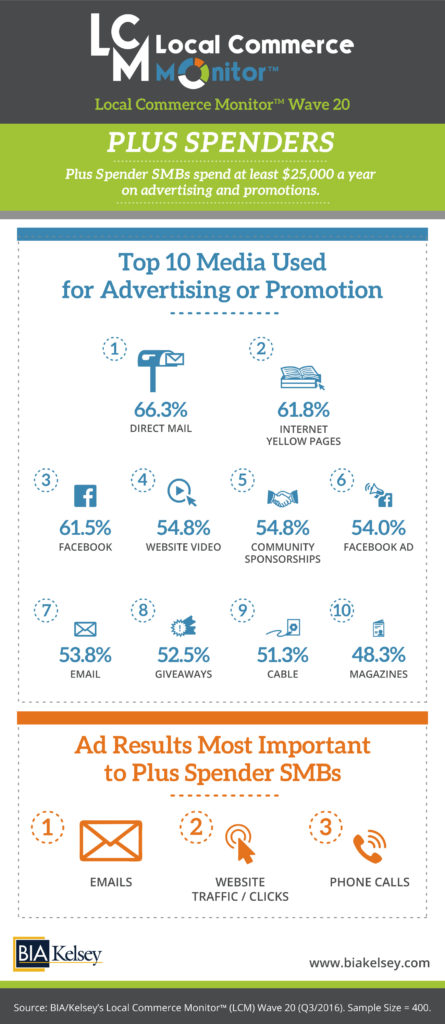

The LCM Wave 20 survey reveals that Plus Spender SMBs are split between preferring Do-It-Yourself digital advertising services, 39.0 percent, and Do-It-With/For Me solutions, 37.0 percent. The top 10 media used for advertising and promotion by Plus Spender SMBs include, in order of usage, the following: Direct mail (66.3 percent), Internet Yellow Pages (IYP) (61.8 percent), Facebook (61.5 percent), website video (54.8 percent), community sponsorships (54.8 percent), Facebook ads (54.0 percent), Email (53.8 percent), giveaways (52.5 percent), cable (51.3 percent) and magazines (48.3 percent).

“Considering the large number of media use, Plus Spender SMBs will inevitably continue to spend on traditional media, particularly in certain verticals, like auto dealers and furniture stores,” added Matthiessen.

When asked which advertising results were important, the top three results ranked over 50 percent, indicating Plus Spender SMBs have specific ROI expectations:

- Emails (53.0 percent)

- Website Traffic/Clicks (51.5 percent)

- Phone Calls (50.5 percent)

Results from BIA/Kelsey’s LCM Wave 20 survey will be profiled at the company’s first event in 2017, LOCAL IMPACT Dallas. The session, Getting Inside the Minds of SMB Advertisers, will explore top findings from the survey, examining Plus Spender and Franchise SMBs in particular. More details can be found here.

Available Reports

Two reports with findings from the Plus Spender SMB portion of the LCM survey are available for purchase: the condensed report, Plus Spenders SMBs TRENDS – LCM Wave 20 and the complete survey and findings, Plus Spenders SMBs REPORT – LCM Wave 20.

About BIA/Kelsey’s Local Commerce Monitor™ Survey

Local Commerce Monitor (LCM) is BIA/Kelsey’s ongoing survey of the advertising behaviors of small and medium-sized businesses. The survey measures where SMBs are spending their advertising and promotional budgets and how their media usage and spending habits are evolving.

LCM Wave 20 tracks 50 different media and platforms used by SMBs for advertising, marketing and promotion. The media fall into 10 top-level categories: online, traditional, mobile, local coupons, social, video, broadcast, local directories, giveaway items and community sponsorships.

For this study, SMB is defined as a business having from 1 to 99 employees. Local Commerce Monitor draws its sample of business respondents from a mix of nationally scoped MSAs, primarily based on first- and second-tier markets. LCM 20 was conducted in Q3 2016 via an online survey of SMBs. The LCM 20 findings have been weighted to reflect the incidence of SMBs by size bracket, according to the SMB size bracket data provided by the U.S. Bureau of the Census.

About BIA/Kelsey

BIA/Kelsey (@BIAKelsey) combines data, analytics and insights to provide its clients with the information they need for grounded financial and strategic action. Since 1983, BIA/Kelsey has been a valuable resource for many of the leading companies in media and the financial and legal community serving media and telecom, as well as the FCC and other government agencies. Today, BIA/Kelsey offers a broad range of research, consulting services and conferences to traditional and new media companies. Learn more about BIA/Kelsey at https://www.bia.com.