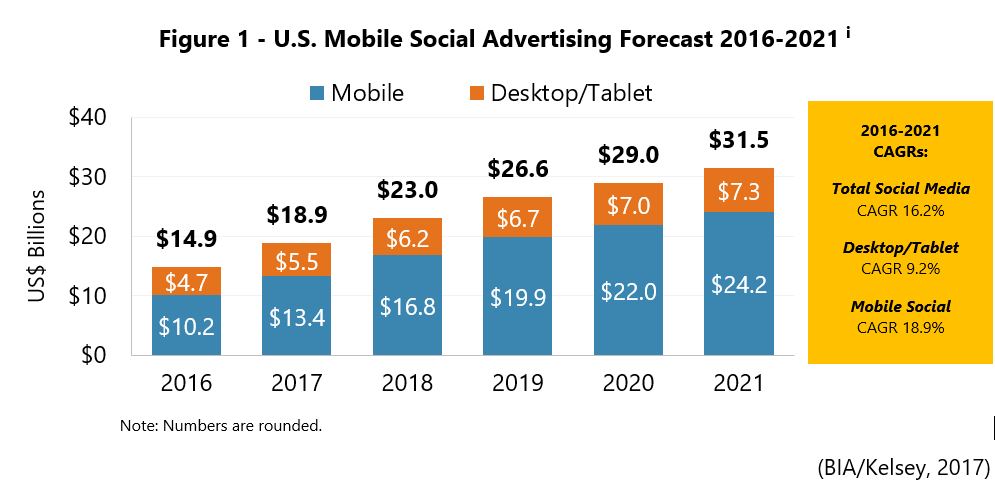

The social media advertising industry targeting local audiences in the U.S. will more than double to $31.5 billion by 2021, up from $14.9 billion in 2016. As social platforms like Facebook have made direct monetization of their platforms a reality, there is a strong need for a social audience currency that enables TV broadcasters to quantify the value of their premium content and audiences to marketers and advertisers. BIA/Kelsey joined forces with ShareRocket to suggest just such a roadmap recently in a complimentary new report, Local TV Station Roadmap for Monetizing Social Media. We see 2017 as the “breakout year” for broadcasters to monetize social media, particularly for Facebook.

The addition of social channels into their marketing solutions empowers broadcasters to develop new audience products for their clients. Social media audience data analytics and insights provide broadcasters with valuable consumer graphs to help develop better audience targeting for advertisers and better programming for audiences. The incremental win for TV broadcasters in social media is to monetize content published on social platforms with incremental ad sales and to increase on-air viewing via social channel promotions and audience engagement. Social media publishing by TV stations and associated goals of audience and advertising revenue growth from these platforms have become central to broadcast business models.

To get to monetization of social media, TV broadcasters should be pursuing four major strategies:

- Audience amplification and extension on social platforms

- Revenue diversification and growth

- Product lifecycle and platform-specific planning

- Audience targeting tied to consumer purchase journeys

The report emphasizes the relevance of Facebook to TV broadcasters for several major reasons:

- Cost of sales are low

- Content costs are low

- New sources of premium video inventory can be monetized

- Scarcity of premium content provides upward pricing pressure since broadcast inventory is limited.

This 26-page complimentary report features 8 data charts, practical advice, insights and local market case studies.