In early 2025, Trump imposed new, strict tariff structures that impacted numerous U.S. trading partners and industries. As BIA updates its U.S. Local Advertising Forecast for all local media channels, these tariffs, along with other macroeconomic trends, will play a significant role in our analysis.

During a TVB event in Washington, D.C., this week, I gave a presentation on local television and discussed the company’s new tariff sensitivity analysis to illustrate how different scenarios can impact advertising spending. To conduct this analysis, we utilized historical data and a Bayesian model to explore three distinct scenarios.

A Bayesian hierarchical model (stan_glmer) was employed to estimate the elasticity of advertising revenue in relation to tariff levels. This model accounts for the varying revenue levels generated by different industries and media channels, comparing tariff impacts relative to each media channel’s past performance rather than using a one-size-fits-all baseline.

The scenarios tested include:

- Legacy Tariff Environment (2.5%): This is the baseline that reflects existing forecast assumptions.

- 2025 Minimum Tariff Level (10%): This reflects recent policy shifts.

- Aggressive Policy Shift (25%): This serves as a stress test for more protectionist trade policies.

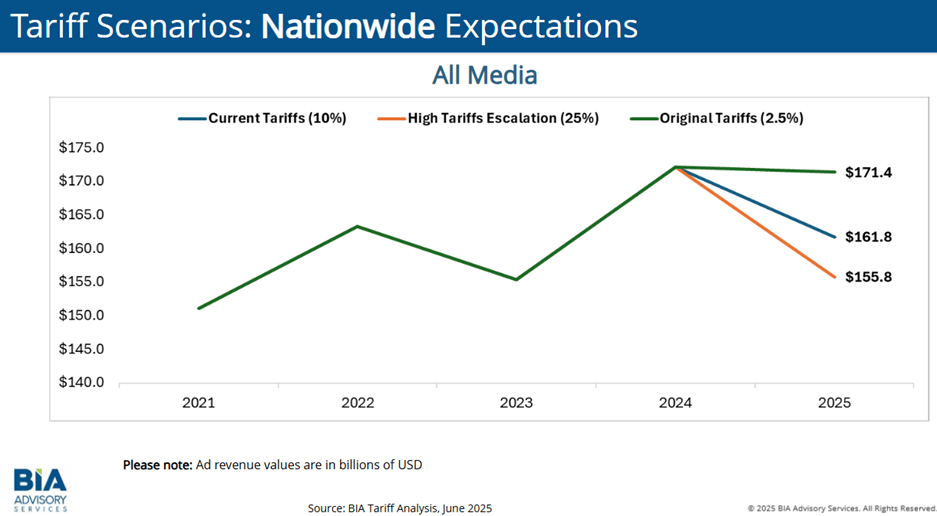

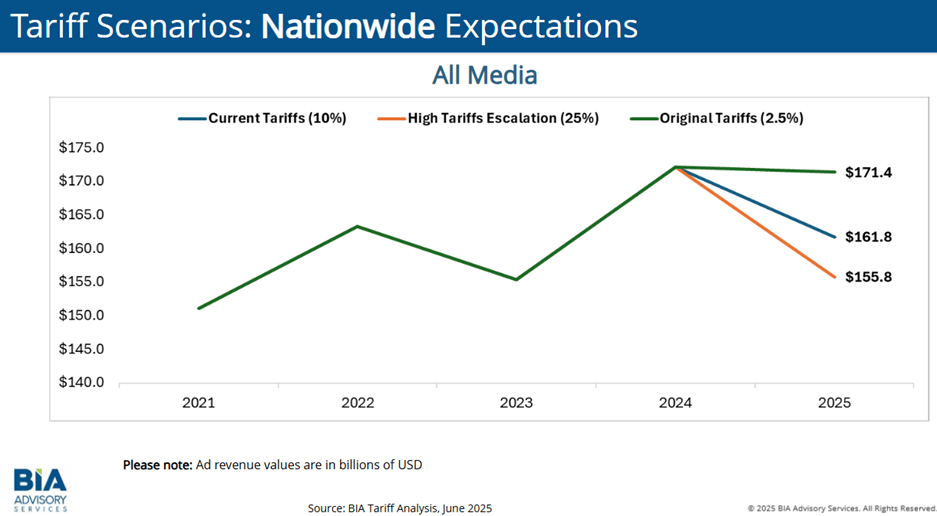

With this foundation, let’s examine the effects on our nationwide advertising revenue estimates.

With the legacy tariff of 2.5% in place, we anticipate total advertising revenue will reach $171.4 billion. If we consider the current tariffs at the minimum level of 10% in 2025, our adjusted forecast will drop to $161.8 billion. However, if tariffs increase to 25% later this year, we may see a significant decline in total advertising revenue to $155.8 billion.

Now, let’s focus on a key local vertical: the Automotive sector. This sector encompasses new and used car dealerships, gas stations, repair shops, and auto parts stores, and it faces various revenue forecasts based on different tariff levels. With a base tariff of just 2.5%, automotive advertising revenue is projected to reach approximately $12.6 billion. However, if the current 10% tariff remains in effect, we could see that revenue decreases to $11.8 billion. If tariffs rise to 25%, revenue will drop to $11.4 billion. Many are concerned about rising prices associated with these tariffs, prompting some consumers to purchase new and used cars sooner rather than later.

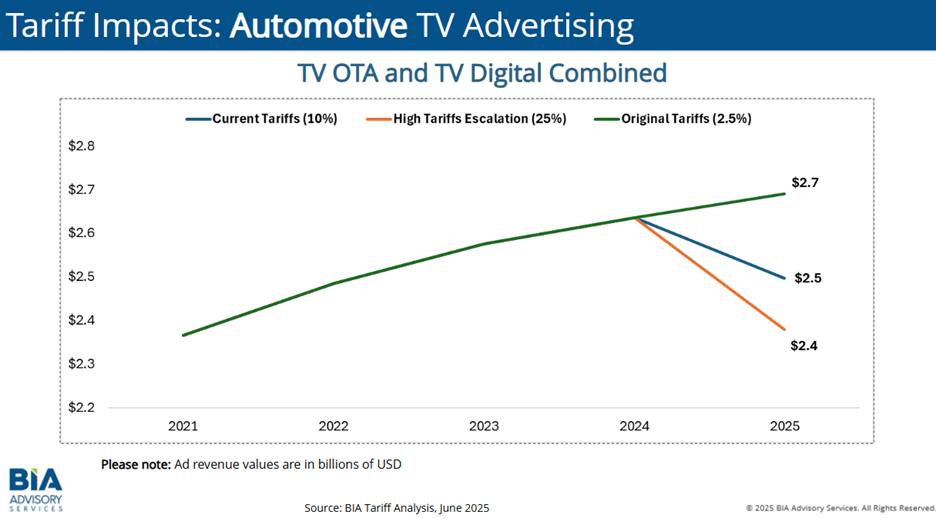

Next, let’s examine television ad spending in the automotive sector, focusing on adjustments for TV over-the-air (OTA) and TV Digital. Our legacy level indicates revenue estimates of $2.7 billion for local television. With the minimum tariff level, our estimate adjusts to $2.5 billion. If the aggressive model is implemented, we expect a further reduction to $2.4 billion.

When focusing on Connected TV (CTV) and Over-the-Top (OTT) advertising, the impact of tariffs is clear. Despite expectations that this media channel will experience the highest growth in our forecast, ad spending is projected to decrease under the most aggressive tariff scenario—from an estimated $4.0 million to $3.6 million.

The impact of automotive spending on television is influenced by a variety of factors. Used car prices are beginning to decrease, representing a shift from the price increases we’ve seen in recent years. This trend may encourage more consumers to enter the used car market. However, if high tariffs persist, sales in this segment could also slow down.

Repair shops and parts retailers are feeling the strain due to rising costs for imported parts, which are making essential repairs and maintenance too expensive for many drivers. As a result, both retailers and consumers face a challenging and uncertain environment, making it more difficult to achieve retail growth.

In our session at the TVB, we analyzed ad spending in the Retail industry, focusing specifically on expenditures for Connected TV (CTV) and over-the-top (OTT) platforms. We are conducting a sensitivity analysis across the 12 super verticals in our forecast and have begun providing insights to our BIA ADVantage clients regarding the overall spending impacts across different media channels, including PC/Laptop, Mobile, Television, and Radio.

For those who are not BIA ADVantage clients, we offer customized tariff sensitivity analysis tailored to local markets, broadcast groups, or individual companies. If you are interested, please email us at advantage@bia.com to discuss how to get a custom worksheet.