Edison Research and Triton Digital just released the The Infinite Dial, a survey of Americans 18+ and their use of radio, digital audio social and other digital media that first launched 22 years ago. While the news headlines tend to focus on the growth of podcast and smart speakers, dig a bit deeper to find a very interesting and promising narrative about radio one might pull out of the data.

Even with all change in technology, audience consumption patterns and shifting ad spend, broadcast radio continues to exert a strong gravitational force among audiences and advertisers. Radio faced a different world when the first Infinite Dial study was conducted a generation ago. Has radio changed enough in this time? Radio can let the future happen, or it can embrace and direct its own future. Radio’s opportunity for “constructive disruption” is now. And the seeds of this disruption pivot on the ability to develop and execute meaningful strategies based on creativity and innovation.

To do so, the radio industry might borrow a page from the Proctor & Gamble’s chief brand officer Marc Pritchard wrote. Speaking to iHeartMedia CEO Bob Pittman on his Math & Magic podcast, Pritchard explained, “We constructively disrupted ourselves. We followed consumers and where they are spending their time because that’s a big aspect of what it’s all about.”

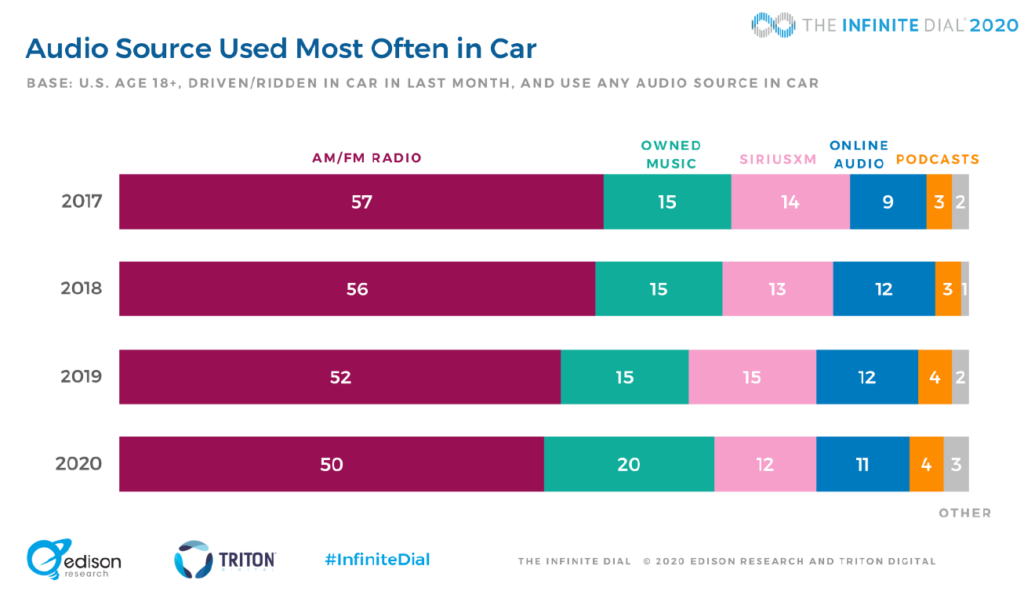

The Infinite Dial 2020 clearly tells us where consumers are spending their audio time, and it’s radio. Especially in the car. Based on the chart below, we can see that radio’s biggest competitor in the car is not Sirius/XM (trending down), podcasting (very low single digits) or even online audio (hovering just over 10%). The biggest share loser was radio from 2017-2020, and the biggest share gainer was owned music. Radio is competing with its own listeners more so than other media.

Take-away #1: Radio can constructively disrupt their audience experience to tap into the unmet audience needs that audiences are having to satisfy themselves, not with broadcast, online audio or podcasting.

This could be a path to material growth for radio. And given the huge platform of being the most used audio source in the car by 50% of the audience, it’s radio’s opportunity to lose.

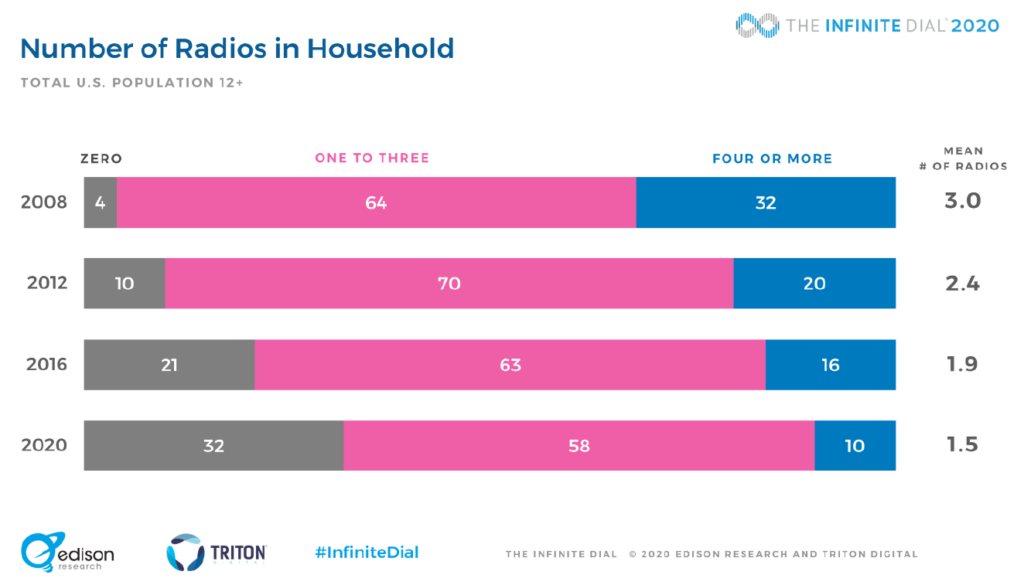

A second remarkable trend brings us inside the home. While radio owns the car, it’s in fast decline on the home front. From 2008 to 2020, the average number of radios in the home declined 50% from 3.0 to 1.5. The number of households with no radios increased from 4% to 32%. This begs the question: Should radio give up the household and focus on the car for its last stand in the audio market? No. The new “radio” in households in 2020 is the smart speaker. As Pritchard says, “go to where the audience is.”

Can the radio industry leverage its huge broadcast platform to bring creativity and innovation to constructively disrupt both the radio and the smart speaker audience experience? To be seen. It’s possible because impossible things do happen.

The average home in 2020 has 2.2 smart speakers, up from 1.7 in 2018. The growth in smart speakers mirrors the decline in household radios. But 49% of households still have radios and no smart speakers.

The smart speaker is the new household radio in 2020, but for half the audience. The other half inevitably will follow the same path of fewer radios and more smart speaker penetration. But for now, the radio industry has two paths into the home – radios and smart speakers. No one else has that platform advantage.

Take-away #2: If you have a platform advantage, scale it.

Certainly we’ve seen how digital players leverage platforms to get to scale. Is this even possible for radio? Think like a platform, not a single operator providing a single service. This can win big business opportunities. Consider again the example set by Marc Pritchard. Quoting from a January 2020 Inside Radio article, “Procter & Gamble went from a virtual no-show to one of audio’s biggest advertisers in a short period of time. It appears to have been the biggest national radio advertiser of 2019. It’s a direct impact of the company’s overhaul of its marketing and media buying strategy, a rethink that now puts podcasts into the equation.

If radio can go from zero to first with Proctor & Gamble in terms of winning ad spending, maybe the idea of construction disruption via creativity and innovation belongs in the real world and not just on a white board.