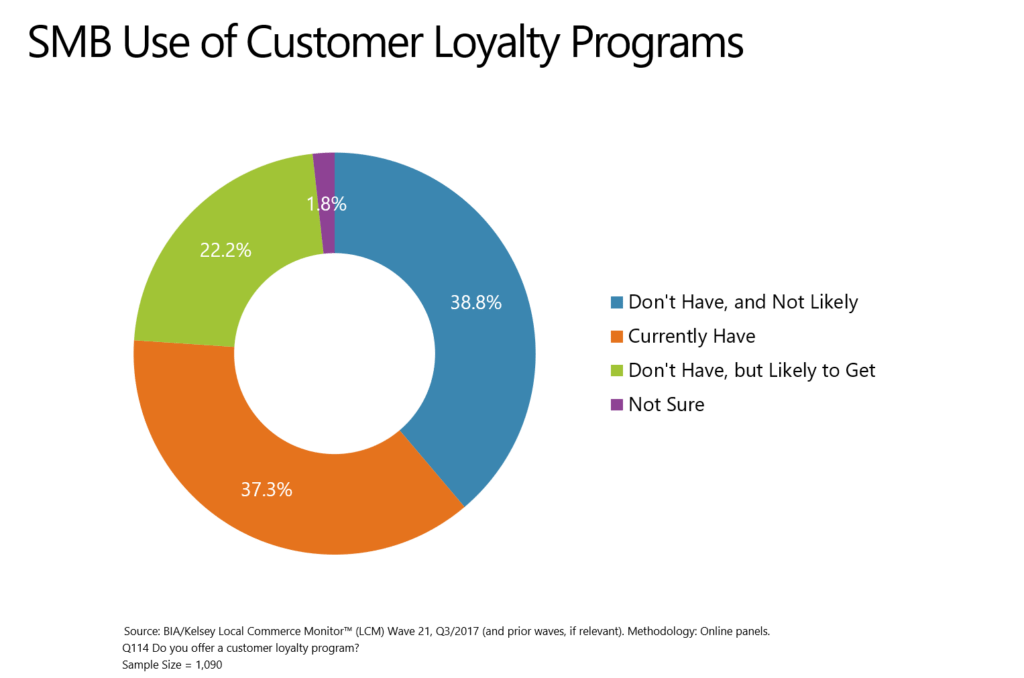

Some businesses have customer loyalty programs and others don’t. According to BIA’s research, about 60 percent of small and medium businesses (SMBs) either have or plan to have a customer loyalty program. Here’s the question: do customer loyalty programs actually create and retain loyal customers?

We had the chance to chat about the whole concept of customer loyalty, what it means, and how to get it with John Larson. Larson and his co-author Bennett McClellan just wrote a new book on this subject.

Acquiring, retaining and converting customers into loyal customers is a Holy Grail for businesses seeking ROI, attractive margins, revenue growth and increased valuations. There’s plenty of research speaking to the relative merits of establishing and curating customer loyalty built on top of acquisition and retention strategies.

Creating customer loyalty in the first place is a mix of art and science. It comes down to understanding that only highly satisfied customers are truly loyal customers, and the best way to create a highly satisfied customer, is to take out as much of the risk in doing business with you as possible. More on this in a bit.

Customer acquisition is an expensive business, so once you have a customer you don’t want to lose her. Harvard Business Review cites research showing that the cost of acquiring a new customer can be, “anywhere from 5 to 25 times more expensive than retaining an existing one.” This same article also cites research by Fred Reichheld of Bain & Company who invented the Net Promoter Score, a measure of how positively customers feel about businesses. Click here for more information on Net Promoter Scores.

Reichheld’s research indicates businesses that can increase their customer retention rates by 5 percent can increase profits by 25 percent to as much as 95 percent. Encouraging research findings like these motivate businesses to develop programs to attract, develop and retain loyal customers.

Loyalty programs, though well meaning, may actually be counterproductive. The benefit of creating “true loyalty” according to Larson is that, Loyal customers consistently give your business preference over all other competitors. That’s not something a loyalty club may deliver.

Consumers tend to belong to multiple loyalty clubs if they belong to at least one. Loyalty clubs attract bargain seekers looking for transactions that advantage them somehow rather than establishing true loyalty with a brand.

The benefits of true customer loyalty to a brand, according to Larson, include: keeping more of the customers you attract, selling them more of the goods and services you offer, getting them to pay price premiums and trading up to better products, changing customer behaviors to lower the cost of servicing them, creating customers that go out of their way to patronize you, and converting customers into brand evangelists.

The benefits of true customer loyalty to a brand, according to Larson, include: keeping more of the customers you attract, selling them more of the goods and services you offer, getting them to pay price premiums and trading up to better products, changing customer behaviors to lower the cost of servicing them, creating customers that go out of their way to patronize you, and converting customers into brand evangelists.

Larson argues that this type of true customer loyalty comes only from creating Highly Satisfied customers. Further, Larson’s research shows a strong empirical and causal link between a group of Highly Satisfied customers and real customer loyalty.

As with Reichheld’s Net Promoter Score, Larson’s measure of Customer Satisfaction is deceptively simple. Larson’s five-point scale ranging from 1=Highly Dissatisfied to 5=Highly Satisfied. But there’s an important difference between the NPS approach and Larson’s approach. The NPS system will give businesses higher scores simply by reducing the number of lower scoring “Detractors.” However, Larson’s approach credits businesses with higher scores only by increasing scores at the top end of the satisfaction scale.

Enlightened businesses should focus on their Highly Satisfied customers, those who score “5s” as the core of their business. Research your 5s and find out how you got them to be Highly Satisfied customers and figure out ways to keep them there. 1s, 2s, and 3s are not “good” customers. For example, Amazon recently moved to ban customers who make too many returns. While customers like this may provide your business with revenue, they are costly and distracting.

The group of customers that are the 4s represent a challenging but profitable opportunity for businesses. Larson says while they don’t behave all that differently from the 1s, 2s, and 3s, they’re the only ones you’re likely to convert to 5s. If a business can convert a 4 to a 5, typically those customers will increase their buying volume by 30 percent to 40 percent.

Customer loyalty programs are popular. BIA’s Local Commerce Monitor of Small and Medium Businesses (SMBs) shows that customer loyalty programs are in use by over a third (37.3 percent) of SMBs that have some form of customer loyalty program. Another 22.2 percent of SMBs plan to develop such a program within the next year. Still, nearly 40 percent of SMBs don’t have customer loyalty programs and are not likely to do so anytime soon.

The use of customer loyalty programs may actually not be achieving their intended goals. Typically customer loyalty programs are meant to increase customer retention, spending and referrals. But these programs may not have what it takes to create a highly satisfied customer and therefore a loyal customer. Larson says their research shows the causal relationship between a customer that sees no risk in dealing with a company and true loyalty toward that company.

What this means is that true customer loyalty is a matter of risk mitigation. Risk comes when a brand “screws up” with the customer. Larson advises brands to literally map out all their Opportunities To Screw Up (OTSUs) with customers and eliminate the risk of these screw-ups happening as best they can. Figure out how to reduce or eliminate risk in the customer experience and you’ve created a truly loyal customer. Interestingly, Larson says that if a brand does screw up, but immediately and satisfactorily fixes it with the customer, that drives even more satisfaction and greater sales. Presumably, this is because the customer feels taken care of and perceives even less risk than before.

As the book’s subtitle promises, Larson and his co-author McClellan offer a detailed playbook for how to measure, generate, and profit from highly satisfied customers. It may cause businesses to rethink what they’re doing with customer loyalty programs. Companies may be better off developing a Highly Satisfied Customer Culture than investing time, effort, and resources into loyalty clubs.

One final note is that Highly Satisfied, truly loyal customers are an intangible asset that should factor into a company or brand’s valuation when performing due diligence or assessing a company’s financial performance. Satisfaction, as measured with Larson’s system, becomes a meaningful metric that can flow into financial dashboards, corporate reporting, and M&A practices.

Updated: February 27, 2020