In the second installment (first one here) of our series exploring major channels in BIA’s U.S. Local Advertising Forecast, we focus on a transformative force reshaping Out-of-Home (OOH): its accelerating digital evolution.

Digital Out-of-Home (DOOH) is rapidly shifting the growth trajectory of the entire channel. With dynamic creative, real-time optimization, audience-based buying, and expanding programmatic capabilities, OOH has now bridged the divide between physical reach and digital measurability. As a result, advertisers can more accurately target audiences, quantify engagement, and integrate OOH seamlessly into broader omnichannel strategies.

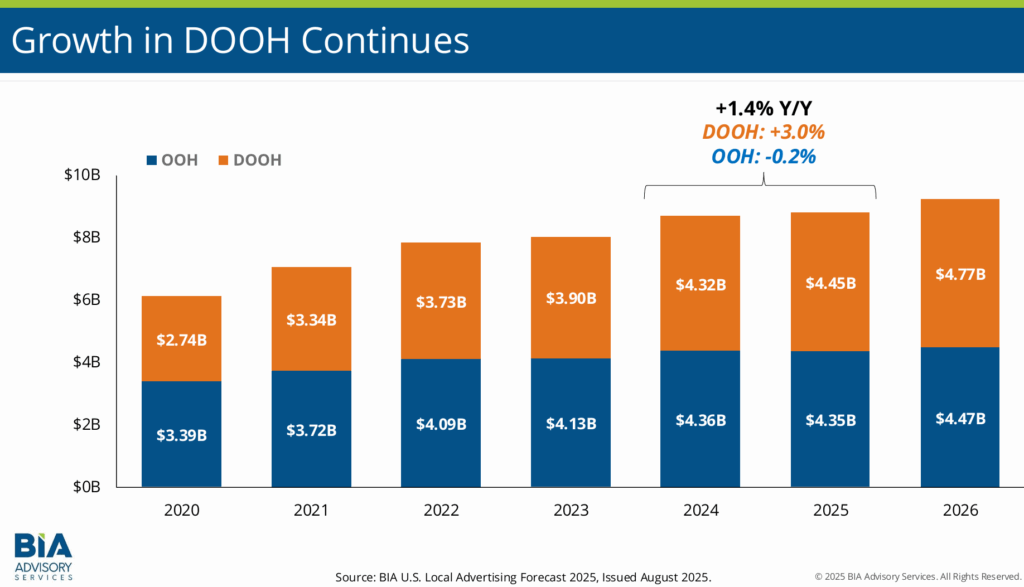

BIA’s latest forecast quantifies this momentum:

- OOH advertising revenue is projected to reach $8.8 billion in 2025 and grow 5% to $9.2 billion in 2026.

- Leading spending categories include leisure & recreation ($2.6B), general services ($1.2B), and finance & insurance ($1.0B) in 2025, with strong category growth ahead for areas such as real estate development (10%), full-service restaurants and bars (8.0%), amusement parks and arcades (7.4%), and quick-service restaurants (6.9%) in 2026.

These gains are driven in part by DOOH’s ability to deliver both creative flexibility and data-rich precision, giving advertisers new confidence in OOH’s performance.

Key Opportunities & Challenges Identified by BIA

BIA’s ongoing analysis highlights several forces shaping OOH performance in 2025 and beyond:

- Rapid expansion of DOOH and programmatic OOH (prOOH)

- Rising competition for local ad budgets from digital platforms, CTV, and social media

- Growing demand for measurable outcomes and precise local targeting

- Market-by-market variation influencing pricing power and revenue potential

These trends raise essential questions for OOH companies and advertisers, including:

- Where are advertising dollars flowing—nationally and at the local DMA level?

- Which business categories are growing fastest, and in which markets?

- How can operators evaluate inventory value and identify opportunities for regional expansion?

- How can OOH clearly demonstrate ROI compared with competitive media channels?

How BIA Helps OOH Firms Answer These Critical Questions

BIA’s enhanced OOH research, local forecasts, and strategic consulting services are designed specifically for media operators, agencies, and technology partners navigating this evolving landscape. We help clients:

- Understand local advertising wallet share and the dynamics that drive OOH spending

- Identify high-growth advertiser categories—including those shifting budgets into DOOH and prOOH

- Benchmark competitive spending and ROI potential, showing OOH’s share versus other local media

- Develop strategies for pricing, regional expansion, investment, and M&A

With deeper local-market intelligence and more precise forecast data, BIA equips OOH companies to capture growth, validate value, and strengthen their position in an increasingly data-driven advertising ecosystem.

If you don’t know BIA and want to learn more about us, or if you know us and want to browse some of our latest OOH materials, here are a few resources:

- BIA OOH Services: Unlocking Growth for OOH Media

- Sneak peek at BIA’s OOH forecast as presented to the OAAA Association

- Visit our OOH insights page here

To contact our team to schedule a briefing on your market opportunities, email us OOHADVantage@bia.com.