Over the weekend I decided I need to start making my own lunch every day and not splurge on delivery. Also, I booked a 12-day vacation in The Netherlands for this Summer. Yep, like most American consumers, I have Inflation Brain.

This “split-brain budgeting” where consumers are looking to save in smaller ways while also splurging on big ticket items is an interesting phenomenon and will have profound impacts on consumption this year.

In this month’s Economic Pulse, we are going to dive into three of these sectors (and one bonus sector) to analyze the growth opportunities for 2023 and why these sectors seem to be immune to current inflation concerns and economic conditions.

Let’s start with Auto. First, it’s important to note that the housing market is very tight due to high interest rates and inflation. But wait, this is Auto. What’s that got to do with housing? Well, real estate’s struggles are benefiting Auto as sales of recreational vehicles are soaring. Boomers and Millennials are leading the charge here for different reasons. Boomers are buying up luxury RVs instead of second (third or fourth) houses. Millennials and Gen Z are being priced out of the traditional real estate market in many cases and, as more work becomes remote, they are deciding to buy recreational vehicles to give them the flexibility to work and travel at the same time.

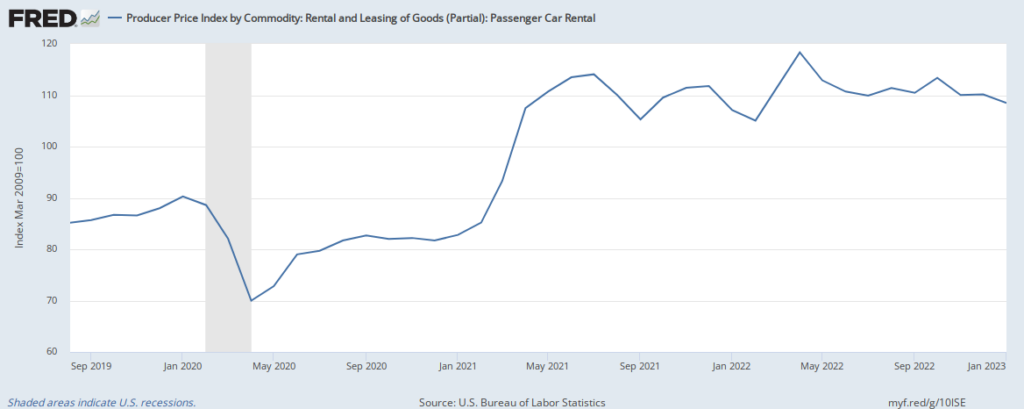

Speaking of getting out on the road, let’s talk about travel. It’s looking like my flight to Amsterdam later this year is going to be crowded! 1 in 4 Americans intends to travel more this year than last year. And, with the US dollar relatively strong versus many foreign currencies, 31% of Americans are more interested in international travel than domestic. But, even with the favorable exchange rates, travel is going to cost more. Most notably, car rental rates are still 36% higher than pre-pandemic rental rates.

Lastly, let’s talk about Luxury Retail. LVMH (Moët Hennessy Louis Vuitton), the world’s leading luxury goods group, recorded revenue of €79.2 billion (about $84 billion) in 2022, up 23% over 2021. 95% of luxury market brands grew revenues in 2022. Even with current global economic conditions, these brands are expected to see another 3-8% growth in 2023. As of now, Gen X and Gen Y are the big spenders here. But, keep an eye on Gen Z and Gen Alpha as their spending here is growing at 3x the speed of the other generations and, by 2030, they will make up one-third of this market spending.

And that bonus category? Let’s talk about the other side of the “split-brain budget.”

Consumers are looking to save on everyday items. Demand for Dollar Stores is surging and new locations are opening in droves throughout rural America. Interestingly, the majority of new customers at Dollar Tree had an annual income of over $80k. I guess I now know where I’ll be stocking up on travel-size shampoo before my vacation!

So, what does all this mean for Local Advertising in 2023? With consumer priorities and spending habits changing as macro-economic conditions evolve, Advertisers will need to stay close to their customers, anticipating their needs.

For local sellers, it is important to understand these different dynamics to present plans that help Advertisers get a leg up on the competition across media channels. I am proud that we at BIA are heavily engaged in these types of conversations every day and working hard to keep our fingers on the pulse.

And I’ll be back the last Monday in March with more! Until then, what about you? Got any plans to buy something big this year? Have you noticed changes to the way you make day-to-day financial decisions? I’d love to hear from you! Send me your questions and thoughts to novadia@bia.com.