I’m heading out on vacation later this week. I’m off to the Netherlands for ten days and, thankfully, I am not going on a cruise as I do want to see Amsterdam. And it looks like repeating this trip again next summer will require a visa (and fee, of course) but I suppose that’s a problem I’ll worry about next year. Until then, it’s just me and seemingly every other American heading to Europe for a break. In total, the number of Americans traveling in Europe this summer is expected to be up 55% compared to last year. Italy is very high on the list of destinations. I must have missed that memo but I did love the most recent season of “White Lotus” so I get the appeal. And for those looking to skip the heat and crowds of Southern Europe, Denmark might be the beach vacation you’re looking for.

But you’re not here for travel advice so why am I talking about my vacation in an economic blog? Well, I’m *really* looking forward to the windmills, bicycles, and soccer (“Fútbol is life!”) but, more importantly, the significant increase in travel this summer speaks to the confidence Americans have in their current financial situations which has massive implications on the economy and Local Advertising spend.

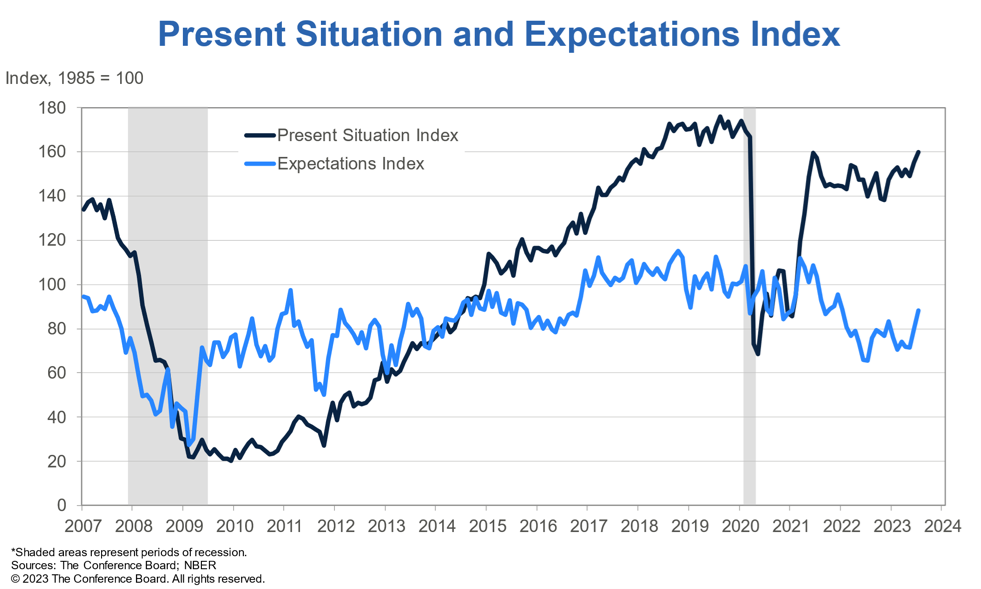

Last week’s Consumer Confidence report for July was very positive with the index increasing about 7 points over June indicating continued and growing confidence in the economy. Additionally, the index is now at 117 which is comparable to where it was in early 2017 (the peak was just shy of 140 in mid 2018). Digging deeper, both the Present Situation Index and the Expectations Index increased in July compared to June which signals that consumers are feeling confident about both the “now” and the “future.”

In fact, the Expectations Index grew to 88.3 which is well above 80 – the level that historically has indicated a recession is coming in the next year. Even with the Fed hiking interest rates last week to the highest level in more than 20 years, consumers continue to spend, and confidence continues to grow.

Considering how tight the labor market is, I’m not at all surprised. In April 2020, at the peak of the pandemic, there were five unemployed people for every job opening. As of May 2023, that number is 0.6 which means, currently, we do not have enough people who want jobs to fill all the ones that are open. This bodes well for employees who can use this tight labor market to push for higher salaries and wages. That, in turn, allows them to consume more, which is what we are seeing play out across many verticals.

Take Christmas In July, for example, which has been a huge success this year for many retailers. One in five consumers said they were going to participate, with women more likely than men, and Gen Z by far the age group that was the most excited. This is great for retailers considering the buying power Gen Z has. Amazon Prime Day 2023 was the most successful ever with nearly $13 billion spent across the two days. Other retailers, such as Walmart and Target, also ran significant deals in July with much success. Heck, even the Hallmark Channel got on board! In all, a strong “Christmas in July” indicates consumer confidence in the upcoming holiday season (Thanksgiving – and Black Friday – are four months away, for those that were wondering…).

But not everything is sunshine and rainbows. There are still significant concerns about inflation. It was great to see inflation fall to 3.0% in June (down a full point from 4.0% in May) but that was more about the fact this is a 12-month rate and so the high numbers from just over a year ago have fallen out of the calculation. Inflation does continue to ease, but it’s been a gradual decline over the last year. Consumers are still concerned and those that are most concerned are indicating they are likely to delay their shopping (holiday and otherwise), waiting for prices to continue to come down. There is an opportunity here for retailers to focus on these price-sensitive consumers that want to feel like they are getting a “deal” before they are willing to make a significant purchase.

Still, as I head out on vacation and I think about the year so far, I, like so many other consumers, am optimistic. At the start of 2023, it felt all but certain the recession we’ve been talking and worrying about would actually hit. Now, I’m less sure. We will have to see how the tight labor market and interest rates play out over the next few months. It’s still probable that we are in or will be in a recession this year, but it doesn’t feel as inevitable as it once did. Unlike my Mets making the playoffs this year, a recession could happen, but let’s save waxing on about my baseball woes for after my vacation…