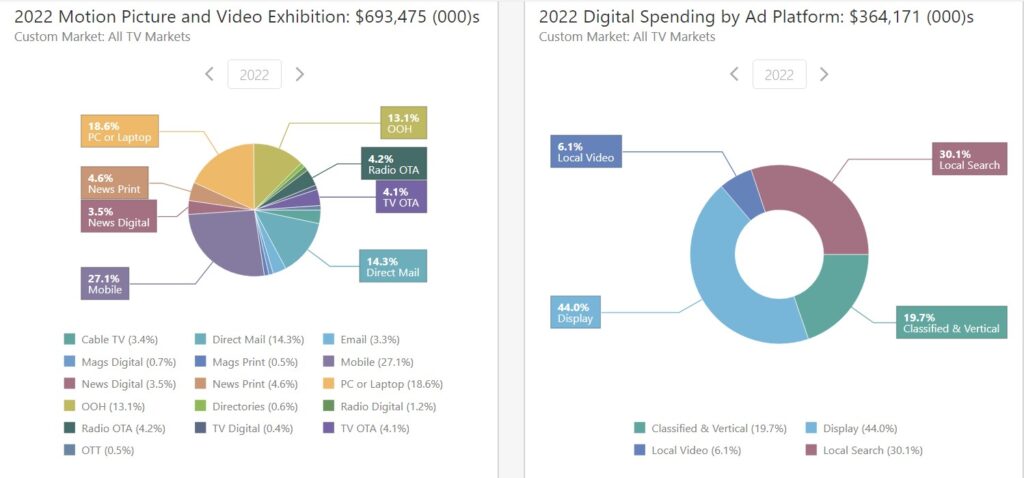

BIA forecasts overall local ad spending by the motion picture industry for 2022 will reach nearly $700 million, more than half of which ($364 million) will be in digital channels. This level of spending has increased year over year since 2020 but has not returned to the nearly $1 billion ($949,772 million) spent for local movie ads back in 2019. (Source: BIA ADVantage, U.S. Local Ad Forecast 2022.)

In BIA’s Leading Local Insights podcast we discuss film industry trends and insights with ScreenEngine/ASI’s chief revenue officer Bruce Friend.

According to Friend, ScreenEngine performs research and analytics for about 60% to 70% of Hollywood films and 65% of TV shows often dealing with audience testing related to storylines, endings and how final editing is determined to maximize positive scores. Depending on how the film scores in this audience testing endings may be reshot, or re-edited to improve responses. Audience testing also influences what resources go into the marketing push and impacts windowing strategies ranging from theatrical release to distribution in the burgeoning streaming market.

Looking ahead into 2022, Friend notes that while film production and title release is rebounding it is still below pre-pandemic levels. In the 2018–2029 period over 900 films were released theatrically compared to just 400 titles in 2020-2021. Friend expects theatrically release film output to increase in 2022 but not by much.

Film studios will continue to focus on big tent pole film events, franchise films for theatrical release but also Direct to Consumer (DTC) film releases. The DTC film market used to be seen as titles not worthy of theatrical distribution but that has changed with the economics of the streaming market with so much investment in original content by players in the Connected TV market. He expects there to be fewer titles and while people are returning to theaters, they will be going to fewer movies each year.

However, the theatrical release strategy is being impacted by shortening release windows into the streaming market. Friend noted that there would often be two marketing pushes one for theatrical release and one for in-home streaming release. Since most films in theatrical release generate most of their revenue in the first several weeks and then go to the premium video on demand and ad-supported markets, this collapsed release window means that more often there may be just one marketing push for films across distribution platforms. The marketing investment has to work for both audiences – theatrical and streaming.

In some cases, films are released directly to the streaming market bypassing the theatrical window. For example, Warner Brothers’ 2021 strategy was to release just to the streaming market, in part to drive subscriptions to HBO Max. Friend expects that strategy to change in 2022 with more theatrical releases as film lovers continue to return to the theaters this year, and perhaps return more often.

On the other hand, according to C|Net, Pixar’s Turning Red feature film will skip theaters and go directly to streaming this week on Disney Plus even though since August 2021 Disney had been premiering exclusively in theaters.

To learn more about BIA’s forecasts for local ad spending in each local market across 16 media platforms to promote theatrical film releases, check out our forecast products and services here.