BIA met with state broadcasting associations over the summer to support their programs and provide valuable insights for their members and clients in a rapidly changing marketplace. We focused on sharing data-driven stories and actionable insights to help local broadcasters and their partners prepare for the second half of 2025 and look ahead to 2026. Most recently, we had the opportunity to speak at a business luncheon meeting with the Indiana Broadcasters Association in Indianapolis, which included local broadcast and agency executives.

There is a growing interest in analyzing and tracking the local advertising market across various statewide regions, not only for political campaigns but also for marketers and agencies developing strategies for multimarket, cross-platform media planning and activation. To support these initiatives, BIA now offers a new Statewide Local Ad Forecast Report, which is based on our August 2025 forecast update for each state. This report provides projections of advertising investments across both traditional and digital media channels, targeting key business sectors such as Automotive, Restaurants, Finance, and Healthcare. It is designed for media planners, agency strategists, broadcast station managers, and C-suite executives. By delivering insights into local advertising trends within each state, the report aims to provide a competitive edge in the ever-evolving advertising landscape.

For Indiana in 2025, BIA expects to see $3.1 billion in total local media ad placements in the core market (i.e., excluding Political), including $1.5 billion in traditional media and $1.6 billion in digital media.

For Indiana media buyers, a core question is how to allocate media mix and weight given consumption patterns in the state. To assist with this challenge, the Indiana Broadcasters Association commissioned Smith Geiger to do a statewide Media Consumption Study with over 1,500 respondents to learn more about trust in media brands, which brands they are spending time with, and how their media consumption compares across channels. As expected, Indiana media audiences use, “a long list of platforms to consume media in 2025” and “continued to be multitaskers that regularly consumed media from multiple platforms at the same time.”

That said, the top consumer media both in total time spent and year over year growth were the “total universe platforms” of local radio and local TV stations comprising the over-the-air, mobile, streaming, social, and other digital channels associated with their brands.

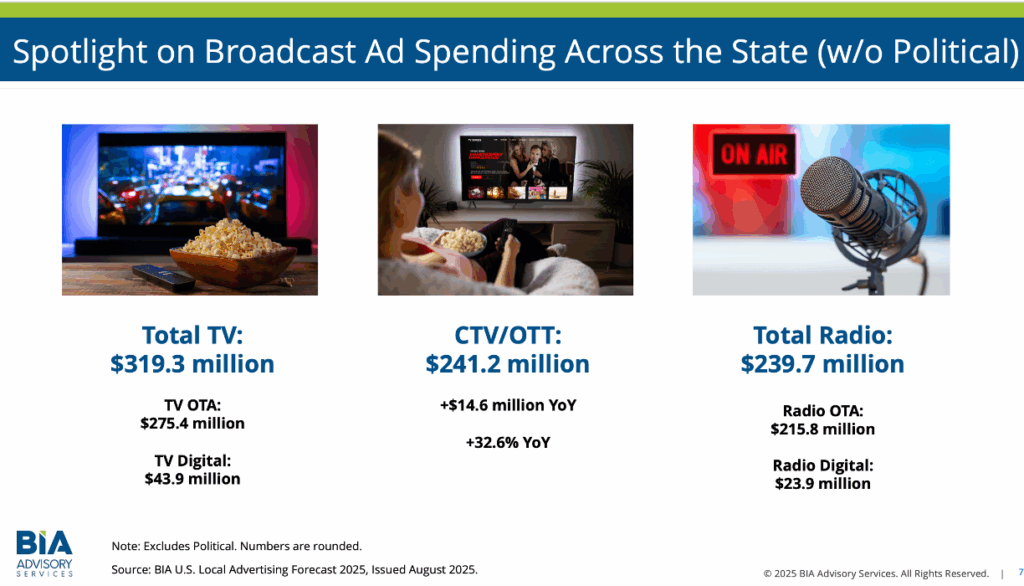

BIA’s media channel definitions include Local TV OTA (over-the-air), TV Digital (e.g., mobile apps, websites, social), Local Radio OTA, Local Radio Digital (similar definitions as Local TV), and Connected TV (CTV)/Over-the-Top (OTT) (e.g., premium streaming video to connected TV sets). Since these were the top media channels consumed by Indiana audiences throughout the state, we provided our 2025 outlook for investment across these platforms.

As we breakout in the chart below, advertisers seeking to reach Indiana audiences across the most popular media channels invested most heavily in the most consumed media. In our 2025 Indiana state forecast, we estimate that TV OTA will receive $275.4 million and TV Digital will get $43.9 million. For Radio OTA and Radio Digital, spending is forecast to reach respectively $215.8 million and $23.9 million. The fast growing CTV/OTT media channel will attract $214.2 million in local ad spending, up $14.6 million (32.6 percent) from 2024.

More about BIA’s Local Forecast Advisory Services and State Reports

BIA’s U.S. Local Advertising Forecast delivers 10-year estimates for 16 media to reveal revenue opportunities and identify trends and opportunities. To prepare a Statewide Local Ad Forecast Report, BIA aggregates all the local markets within a state to provide an overview of local advertising spending in both traditional and digital media.

The report examines:

- Total ad spending within a state

- Analysis of digital versus traditional ad spend

- Top media channels by spend

- Local television ad spend (over-the-air (OTA) and digital television)

- Local radio ad spend (over-the-air (OTA) and digital radio)

- CTV/OTT ad spend

- Business vertical spending in key categories

- BIA insights and analysis

The report is designed for media planners, agency strategists, broadcast station managers, and C-suite executives. It empowers awareness of local advertising trends within a state, providing a competitive edge in the evolving ad landscape

Click here to learn more and purchase a state advertising forecast report. If you are an Indiana broadcaster or operating within this state’s television markets, click here to view more about your state report and local market performance reports.