As the FCC considers new ownership rules, radio broadcast owners may find this an opportune moment to evaluate whether to sell their stations or retain them. At BIA, we believe that all significant financial decisions should be backed by data and insights that offer a clear understanding of industry trends and expert financial analysis.

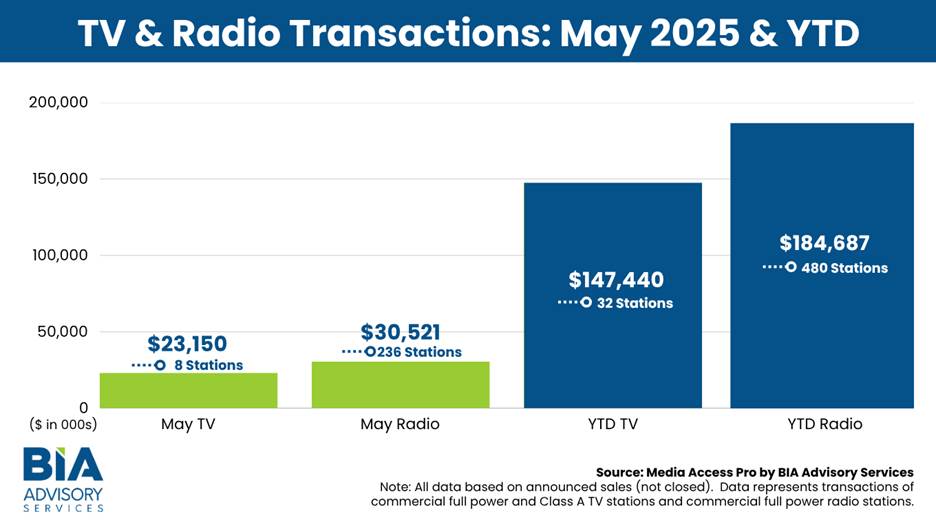

Between January and May 2025, 236 radio stations changed hands, resulting in a total transaction value of $30.5 million. Much of this M&A activity came from trading by religious, non-commercial owners. There remains some distance between commercial radio station owners and prospective buyers, both in terms of valuation multiples and potential synergies that could be applied should ownership caps be relaxed. The FCC has prioritized modernizing radio and TV ownership rules to make these services more competitive, particularly in light of the rapid growth of digital media.

What might take off in a prospective radio market with ownership changes assuming more stations in a market can be commonly owned. We can help clarify your choice to sell or retain by providing benchmarks, market intelligence, and valuation expertise by empowering you to make informed decisions. Additionally, we can assist in positioning your station(s) to maximize sales proceeds.

By following key steps, owners can methodically assess their options and select the path that aligns best with their goals. Let’s discuss how we can assist you in this process.

1. Financial Performance and Valuation

Begin by analyzing your station’s revenues, cash flow, profit margins, and expenses. BIA provides detailed local advertising forecasts and market-specific revenue data, enabling you to benchmark your financial performance against similar stations. Our proprietary valuation consulting can provide a defensible estimate of your station’s market value, drawing on industry multiples and local market trends.

2. Market Trends and Competitive Position

BIA tracks and analyzes advertising spend across radio, digital, and other media to provide a clear sense of where local ad dollars are going and how your station compares in the market. Our market reports provide detailed insights into audience trends, advertiser demand, and competitive shifts, enabling you to assess whether your market is growing, consolidating, or being disrupted by digital audio and streaming.

Another key consideration is the positioning of your station. To maximize sales proceeds, we can analyze how your station could benefit specific buyers based on your programming and sales efforts.

3. Regulatory Environment and Compliance

The FCC’s rules around radio ownership and station transfers are complex. BIA’s consulting services can help you understand the risks and anticipate how potential policy changes might affect your options or the timing of a sale.

4. Strategic Alternatives and Custom Analysis

Sometimes, holding and investing in your station—by upgrading tech, adding new formats, or expanding digital—can boost long-term value. We can provide custom strategic consulting to help owners evaluate scenarios, assess competitive threats, and model the financial impact of different choices. These data-driven insights can reveal opportunities for growth or highlight when a sale may be more advantageous.

5. Tax, Legal, and Personal Considerations

Selling a station brings tax implications and legal complexity. BIA’s valuation and transactional expertise can support your advisors as you structure a sale, ensuring you maximize after-tax proceeds and comply with industry best practices. We can provide transaction data and buyer/seller market intelligence to help you time your exit for optimal results.

Deciding whether to sell or retain a radio station can be a challenging decision. However, with our market data, valuation expertise, and strategic advice, I believe that you can make informed decisions based on your station’s performance and the current trends in the radio industry. Our goal is to always ensure that you have the best insights to navigate each step of the process successfully.

What are the next steps?

- Please feel free to contact me or my team at valuations@bia.com to start a discussion. We are ready to assist you at any stage of the process.

- Additionally, learn more about our services and fill out a short form to download a sample of the data we offer to support your M&A activities

- Learn about our new M&A Guide: Local Market Snapshots, which is available for the top 50 and 51-100 local markets. You can find it here.